AstraZeneca Drug Discounts Show Pharma’s Response to Trump’s Pressure

With a Trump administration deadline looming, AstraZeneca announced it will cut prices on key asthma and diabetes drugs by as much as 70%.

The move is part of a broader trend: drugmakers racing to roll out direct-to-consumer platforms to meet demands for lower U.S. drug prices.

The announcement

Starting October 1, AstraZeneca will allow eligible patients to buy Airsupra and Farxiga directly for cash at steep discounts.

The company joins Bristol Myers Squibb, which earlier this week expanded its own program with up to 80% discounts on select medicines.

Both announcements follow Trump’s July warning: companies had until September 29 to propose meaningful price cuts or face government action.

Why it matters

- Direct-to-consumer shift: Pharma is bypassing pharmacy benefit managers and insurers to show immediate price relief.

- Preemptive strategy: Discounts may blunt harsher policy moves, including Medicare price negotiations and international benchmarking.

- Sector signal: Multiple drugmakers moving at once suggests industry consensus: Trump’s deadline has real teeth.

Market implications

Investors are weighing the trade-off: near-term revenue compression versus long-term regulatory certainty.

AstraZeneca stock edged higher after the news, suggesting Wall Street prefers voluntary, controlled discounting over forced, unpredictable cuts.

Still, analysts warn margins will tighten, especially if discounts extend to blockbusters across diabetes, oncology, and autoimmune franchises.

Trading takeaways

For traders, the theme is clear: pharma stocks are cheap relative to the market, but policy headlines will drive volatility.

Relief rallies are possible if companies get credit for meeting Trump’s demands without deeper government intervention.

But risk remains if regulators decide voluntary cuts don’t go far enough.

Day trading ideas

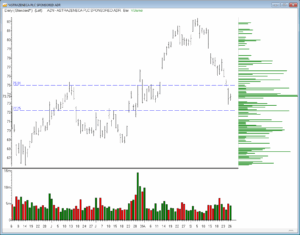

- AZN intraday momentum: Watch AstraZeneca (AZN) around the $70–72 range. Breakouts above resistance could trigger fast momentum trades on positive news flow.

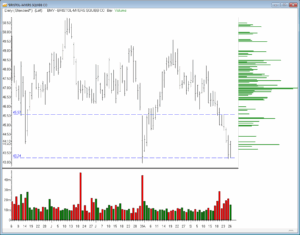

- Sector sympathy plays: Bristol Myers (BMY) and Novo Nordisk (NVO) may move in sympathy as traders anticipate further discount announcements. Look for gap setups at the open.

- Headline scalps: Expect volatility spikes around Sept. 29 — the Trump deadline. Quick reaction trades on breaking headlines could offer scalping opportunities.

- Pairs trade: Long AZN vs. short SPDR S&P Biotech ETF (XBI) if AstraZeneca’s voluntary cuts appear better received than peers forced into deeper concessions.

Technical levels to watch

| Ticker | Support | Resistance | ATR (14d) |

|---|---|---|---|

| AZN | $72.25 | $75.01 | $1.31 |

| BMY | $43.25 | $45.57 | $0.90 |

Use the ATR (Average True Range) as a volatility gauge. A breakout above resistance with volume could target 1–1.5 times the ATR extension intraday.

Conversely, failed breakouts back through support may set up short entries with tight stops.

Bottom line

AstraZeneca drug discounts highlight the new playbook: go direct, slash prices, and try to stay ahead of Washington.

For investors, that means compressed margins. For day traders, it means headline-driven setups, sympathy plays, and now clear technical levels for intraday execution.

Volatility is opportunity — but only if risk is managed tightly.