Forgotten Profits Trade Setup Archive

Below you'll find Ian's setups stacked up and ordered chronologically. As this service once resided at another home, the alerts only go back to mid July. For a full track record, see the portfolio.April 2, 2025

Tariffs – How to Profit from Trading Volatility and Order Flow

Capitalizing on Market Volatility and Order Flow Amid New Tariffs

As the United States approaches April 2, designated by President Donald Trump as “Liberation Day,” the nation stands on the precipice of significant economic transformation. The administration’s plan to implement extensive tariffs aims to recalibrate trade balances and bolster domestic industries. However, this strategy carries a spectrum of anticipated effects across various sectors, from consumer goods to manufacturing, and extends its influence into the global economic arena. For those engaged in trading volatility and order flow, this economic backdrop presents both challenges and opportunities.

Impact on Consumer Prices

The imposition of tariffs is poised to directly affect consumer prices, particularly in essential categories such as food and automobiles. For instance, the average cost of 3 pounds of frozen beef, currently at $26.67, could rise to $27.76 under a 10% tariff on all goods, with even steeper increases if higher tariffs are applied to specific imports. Such price escalations are expected to strain household budgets, especially for families already navigating financial constraints. (The Independent)

Manufacturing Sector Challenges

The manufacturing landscape is experiencing heightened uncertainty. The Institute for Supply Management’s manufacturing PMI declined to 49.0 in March, indicating contraction after a brief period of growth. Factors contributing to this downturn include decreased new orders, reduced factory production, and increased input costs due to tariffs on materials like steel and aluminum. These challenges have led to job reductions within the sector, with expectations of further employment declines as the full impact of tariffs unfolds. (U.S. News and World Report)

Market Volatility and Investor Sentiment

Financial markets have responded with notable volatility. The S&P 500 entered a technical correction in March, largely attributed to apprehensions surrounding the impending tariffs. Investors are bracing for potential inflationary pressures, diminished corporate profits, and decelerated economic growth. Sectors such as technology and automotive have experienced significant stock fluctuations, reflecting broader market trepidation.

Labor Market Implications

The labor market is showing signs of strain, with job openings decreasing by 194,000 to 7.568 million in February. This reduction is largely attributed to the economic uncertainty spurred by the new tariffs. Economists express concern that these trade policies may lead to further layoffs and a slowdown in hiring, potentially elevating unemployment rates in the near term. (Reuters)

Global Trade Relations and Economic Outlook

Internationally, the tariffs have elicited apprehension among trading partners, raising the specter of retaliatory measures and escalating trade tensions. This climate of uncertainty has prompted financial institutions to adjust economic forecasts downward. Goldman Sachs, for example, has increased the probability of a U.S. recession to 35% within the next year, citing the administration’s trade policies as a significant factor. (Wall Street Journal)

Why This “Bad News” is Good News for Traders

While these developments spell trouble for consumers and long-term investors, they open a window of opportunity for traders who specialize in trading volatility and order flow. Market uncertainty fuels short-term price swings, volume surges, and institutional repositioning—all of which can be profitably exploited by nimble traders.

Traders using strategies such as Volatility Band Trading, 2SD Opening Gap plays, and order flow analysis can benefit from the chaos that shakes long-term portfolios. To improve your ability to profit from these conditions, check out our Volatility Band Trading Plan, or dive into the 2SD Gap Strategy.

These turbulent markets are also ideal for those enrolled in the Income Trading Boot Camp, which trains traders to harness trading volatility and order flow with institutional-grade tactics.

Conclusion

As “Liberation Day” approaches, the anticipated tariffs are set to usher in a period of economic recalibration. While the administration aims to strengthen domestic industries and address trade imbalances, the immediate and medium-term effects suggest a complex landscape. Consumers may face higher prices, industries could grapple with increased costs and supply chain disruptions, and the broader economy may experience heightened volatility.

However, in active trading, these conditions highlight the importance of mastering trading volatility and order flow. Traders equipped with the right strategies, tools, and mindset may find that the greatest potential for profit lies in market turmoil.

Good Trading,

Adrian Manz

April 1, 2025

Why Is Tesla Stock Falling? Inside the EV Giant’s Worst Quarter Since 2022

Why Is Tesla Stock Falling? Inside the EV Giant’s Worst Quarter Since 2022

Tesla’s stock has entered turbulent territory once again. Investors are asking, why is Tesla stock falling at such an alarming rate? The electric vehicle maker just posted its worst quarter since late 2022, with shares plummeting 36% in the first three months of 2025. This sharp drop has reignited concerns about the company’s fundamentals, political entanglements, and its path forward in an increasingly competitive market.

A Market Rout for Tesla

The 36% plunge in Tesla shares marks the third-steepest quarterly decline in the company’s 15-year public history. The last time the company faced a bigger loss was in Q4 2022, when CEO Elon Musk sold more than $22 billion in stock to fund his $44 billion acquisition of Twitter (now X).

In Q1 2025, over $460 billion in market cap vanished. This loss overshadowed even Musk’s latest efforts as the head of the Department of Government Efficiency (DOGE), where he claims to have saved $140 billion in federal spending.

But why is Tesla stock falling despite these efforts? Investors seem less focused on theoretical savings and more concerned with real-world headwinds facing the EV titan.

Political Chaos and Consumer Backlash

Musk’s dual role in the Trump administration as leader of DOGE has created a political firestorm. His aggressive stance on government cuts and his backing of far-right candidates have led to widespread protests, boycotts, and even violence targeting Tesla stores globally.

Further complicating matters, Trump’s newly implemented tariffs on auto parts from Mexico and China are expected to directly affect Tesla’s supply chain. CNBC reports that these tariffs have fueled a broader selloff in tech stocks, with the Nasdaq falling 10%—its worst quarterly performance since 2022.

Weak Vehicle Sales and Broken Promises

Tesla’s problems extend beyond politics. Sales of new vehicles are down sharply, while competitors are making aggressive gains. Tesla is also under pressure to deliver on long-promised advancements in self-driving tech.

For years, Musk has assured investors that existing Tesla vehicles could become robotaxis with a simple software upgrade. But now, Tesla admits that a hardware upgrade will be required, pushing deadlines and casting doubt on the feasibility of a mid-2025 launch in Austin, Texas.

This pattern of overpromising and underdelivering is another key reason why Tesla stock is falling.

Lessons From the Past

Despite the current downturn, history shows that Tesla stock has bounced back from similar slumps. In Q1 2024, the company experienced a 29% drop due to slowing sales and increased competition. Yet by year-end, shares had surged 63%, rewarding long-term holders who stayed the course.

In a recent rally in Green Bay, Wisconsin, Musk hinted at the same resilience, calling the current dip a “buying opportunity.”

The Road Ahead

The question why is Tesla stock falling has no single answer—it’s a perfect storm of political controversy, operational missteps, regulatory pressure, and weakening consumer sentiment. For traders and long-term investors alike, understanding the broader landscape is critical.

Market Outlook This Week: Tariffs Could Trigger Inflation and Recession Fears

This Week’s Market Outlook: Tariffs Trigger Inflation and Recession Fears

As the new trading week begins, investors are bracing for turbulence. The dominant theme: tariffs trigger inflation and recession fears. Goldman Sachs issued a stark warning this weekend, noting that a new wave of proposed tariffs could spike consumer prices, depress economic growth, and increase the probability of a U.S. recession. Read the full CNBC article

What’s Driving Market Volatility

Goldman Sachs Warning on Tariffs

According to Goldman Sachs economists, the proposed trade measures, including potential auto import tariffs and increased levies on Chinese goods, could shave off as much as 0.4% from GDP over the next year. More importantly, they stress that tariffs trigger inflation and recession fears by increasing costs for businesses and consumers.

Economic Reports to Watch

Several high-impact economic indicators this week could amplify concerns that tariffs trigger inflation and recession fears:

-

ISM Manufacturing PMI (April 1) – A critical read on supply chain stress.

-

ADP Employment (April 2) – Will hiring slow in anticipation of rising costs?

-

Non-Farm Payrolls (April 4) – A major gauge of labor market strength.

These reports will either confirm or contradict the recession narrative Goldman Sachs warns about.

Technical Market Signals

The S&P 500 and Nasdaq closed last week below their 200-day moving averages. This bearish signal comes as tariffs trigger inflation and recession fears across multiple sectors. Market breadth is narrowing, and traders are shifting toward defensive plays like utilities and consumer staples.

Earnings That Matter This Week

Traders will closely watch:

-

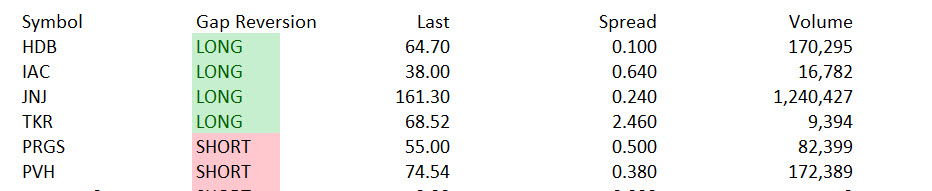

PVH Corp and RH for signs of consumer strength

-

Lamb Weston for margin compression due to higher input costs

If earnings guidance starts referencing tariff-related inflation, expect more downside.

Trading Strategy Focus

For active traders, the narrative that tariffs trigger inflation and recession fears suggests:

-

Tighten stop losses and reduce trade sizes

-

Focus on volatility breakouts early in the session

-

Avoid holding positions through macroeconomic data releases

If you’re a War Room or Boot Camp student, refer to the Volatility Band Trading Plan to guide setups during uncertain weeks like this.

Final Thoughts

This week’s market sentiment will likely be driven by the idea that tariffs trigger inflation and recession fears. With technical indicators aligning with macroeconomic risks, traders should be nimble, data-driven, and ready to act on fast-moving setups.

March 28, 2025