Forgotten Profits Trade Setup Archive

Below you'll find Ian's setups stacked up and ordered chronologically. As this service once resided at another home, the alerts only go back to mid July. For a full track record, see the portfolio.November 12, 2024

Mindfulness in Trading

The Importance of Using a Good Trading Simulator When Learning to Trade or Testing New Strategies

Stock Trading Simulators

Learning to trade or developing new strategies requires skill, discipline, and practice. However, practicing in the live market can be risky and costly for beginners or those testing unfamiliar approaches. A high-quality trading simulator offers a solution, providing a safe and effective environment for developing trading skills without risking real money. TradingSim is a favorite among simulators, providing a comprehensive platform for practicing trades, analyzing strategies, and honing trading skills.

1. Why a Trading Simulator is Essential for Beginners

Understanding the fundamentals and building confidence is crucial for new traders. Stock trading simulators replicate live market conditions, allowing users to practice in a controlled, risk-free environment.

Understanding Market Mechanics: Simulators help beginners familiarize themselves with the market and understand how stocks, futures, or forex products behave under various conditions.

Learning Without Financial Risk: Trading in real markets without sufficient experience can lead to significant losses. Simulators allow you to develop skills without financial consequences, making mistakes and learning from them safely.

Building Confidence: New traders often hesitate due to fear of losses. Using a simulator like TradingSim helps build confidence by allowing practice without financial pressure, helping traders develop the self-assurance they need to make decisive moves in live markets.

2. Testing and Refining Strategies in a Risk-Free Environment

For experienced traders, a simulator can be just as valuable when testing or refining new strategies. Market conditions evolve, and having the flexibility to adapt and test approaches is key to staying successful.

Backtesting Historical Data: TradingSim offers access to historical market data, allowing traders to simulate trades in past market conditions. This is invaluable for analyzing a strategy’s performance during different market environments.

Experimenting with New Approaches: A simulator allows you to test various entry and exit points, technical indicators, and risk management strategies without risking real capital. You can assess the performance of each strategy in simulated scenarios and make adjustments as needed.

Improving Decision-Making Speed: Day trading requires quick thinking and making snap decisions. Simulators help you build this skill by repeatedly exposing you to market scenarios so you’ll become faster and more accurate in your live trading.

3. TradingSim: A Top Choice for Simulation

TradingSim is one of the best simulators for traders of all levels. Its unique features make it a standout tool for learning and strategy refinement.

Realistic Market Experience: TradingSim uses real historical data, allowing users to trade as if it were happening live. The platform provides an accurate replication of market movements, enhancing the realism of each trading session.

Customizable Timeframes and Replay Options: One of TradingSim’s standout features is its flexibility in replaying market data. Users can speed up, slow down, or pause the action to analyze and practice at their own pace, making it ideal for learning new techniques.

Comprehensive Charting Tools: TradingSim includes various charting tools and technical indicators, letting traders experiment with different setups and technical analyses. The platform’s visual tools make tracking and understanding market trends easy.

Performance Analytics: TradingSim’s detailed analytics allow you to review each simulated trade’s performance, helping pinpoint improvement areas. You can refine strategies based on actual performance metrics by analyzing your trades.

4. Developing Psychological Resilience in Simulated Environments

Trading psychology is a critical factor in success, and a simulator like TradingSim helps you build the mental discipline required to trade effectively.

Managing Emotions: Fear and greed are two major obstacles for traders. Practicing in a simulator helps you experience the ups and downs of trading without the emotional weight of real financial stakes, allowing you to develop a balanced approach.

Adhering to a Trading Plan: A good simulator encourages you to follow and stick to a trading plan. Practicing in a simulator reinforces the discipline of following your strategy, which is crucial for long-term success.

Handling Losses and Learning from Mistakes: Everyone experiences losses in trading. Simulators provide an opportunity to handle losses in a risk-free way, building resilience and learning lessons that would be costly in real markets.

5. Transitioning from Simulation to Live Markets

While a trading simulator is an excellent tool, transitioning to live trading requires additional considerations.

Gradual Transition: Even if you’ve consistently succeeded in simulation, consider starting small in live markets. The psychological element differs when real money is at stake, so a gradual approach can help bridge the gap.

Review and Adjust: Continue to use TradingSim or similar tools to review trades, experiment, and refine your approach. Simulators can remain vital to your routine, helping you adapt to market shifts and test new ideas.

Maintain a Journal: Whether in a simulator or live trading, keeping a journal of trades can provide insights into what works and what doesn’t. Tracking your thoughts, decisions, and trade outcomes will help reinforce good habits and identify areas for improvement.

Final Thoughts

A high-quality trading simulator like TradingSim is essential for anyone learning to trade or refining their strategies. It provides a risk-free environment for practice, valuable analytical tools, and a platform to hone technical skills and trading psychology. By committing to simulated practice, traders can build a solid foundation, increase their confidence, and ultimately improve their chances of success when they enter live markets. Whether you’re a beginner learning the basics or an experienced trader testing new strategies, using a simulator can be one of the most valuable investments in your trading journey.

Good Trading,

Adrian Manz

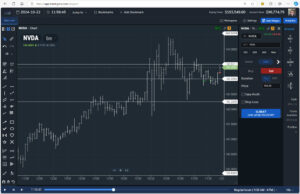

How to Day Trade NVIDIA (NVDA)

NVIDIA Corporation (NVDA) has become one of the most popular stocks for day traders due to its liquidity, volatility, and position as a leader in the tech and semiconductor industries. With the rise in demand for GPUs, AI applications, and machine learning, NVDA’s stock movements are influenced by sector-specific developments and broader economic conditions, providing ample trading opportunities. Below are some insights and strategies on how to day trade NVIDIA (NVDA).

1. Understand NVDA’s Market Behavior and Influences

NVIDIA’s stock is impacted by a variety of factors, including:

Earnings Reports and Guidance: NVIDIA typically experiences price volatility around earnings releases. Watch for scheduled earnings announcements, often providing trading opportunities before and after the event.

Sector Trends and Tech News: NVDA is a leader in AI and semiconductor manufacturing. Positive or negative news about AI, data centers, gaming, and cryptocurrencies can cause sharp movements.

Market Sentiment and Economic Announcements: Given NVIDIA’s size and popularity, it is influenced by broader market sentiment, especially during announcements about interest rates, inflation, and employment data. Be mindful of economic reports that may impact the NASDAQ.

2. Key Technical Indicators for NVDA Day Trading

To maximize profitability, it’s essential to use technical indicators to help you accurately time entries and exits. Here are some effective tools for trading NVDA:

Moving Averages: Short-term moving averages, such as the 9-day or 21-day exponential moving averages (EMAs), are used to gauge momentum. When the price crosses above or below these EMAs, it often signals a trend reversal.

Relative Strength Index (RSI) can help identify overbought or oversold conditions. When NVDA’s RSI is above 70, it may be overbought; below 30, it could be oversold. Look for a reversal when the RSI enters these zones.

Volume and VWAP (Volume-Weighted Average Price): VWAP is crucial for identifying the average trading price over a specific period, weighted by volume. When NVDA trades above VWAP, it’s typically a bullish signal; when it’s below, it’s bearish. Additionally, increased volume often precedes significant price moves.

Support and Resistance Levels: Identify significant price levels where NVDA has historically reversed or consolidated. These levels act as psychological markers, often guiding the price’s next movement. It can signal a potential continuation if NVDA breaks a strong resistance level on high volume.

3. How to Day Trade NVIDIA (NVDA) – Proven Strategies

NVDA’s high volume and volatility make it suitable for various day trading strategies, including the following:

A. Opening Range Breakout (ORB)

The first 30 minutes after the market opens often sets the tone for NVDA’s intraday price action. This strategy involves identifying the high and low prices within the first 15–30 minutes and entering a trade when NVDA breaks above the high (for a long trade) or below the low (for a short trade).

Entry: Buy if NVDA breaks above the opening range high; sell short if it breaks below the opening range low.

Exit: Place a stop loss just below the breakout level (for long trades) or above (for short trades). Take profits gradually as NVDA moves in your favor.

B. VWAP Pullback Strategy

The VWAP pullback strategy is popular for trading highly liquid stocks like NVDA. When NVDA’s price pulls back to the VWAP after trending higher, it often allows one to enter the trend’s direction at a better price.

Entry: Enter a long trade if NVDA has been trending up and then pulls back to VWAP, or go short if it’s trending down and pulls back to VWAP.

Exit: Set a stop loss just below VWAP (for long trades) or above (for short trades) and look for profit targets at recent highs or lows, or even as it moves away from the VWAP.

C. Momentum Trading with RSI Divergence

NVIDIA’s stock frequently experiences momentum-driven moves, especially during high volatility sessions. This strategy involves using RSI divergence as a signal for reversals in high-momentum situations.

Entry: If NVDA’s price is making higher highs while the RSI is making lower highs (bearish divergence), consider shorting; if the price is making lower lows while the RSI is making higher lows (bullish divergence), consider going long.

Exit: Exit once the divergence is confirmed by a price reversal or a breakdown in the trend. For protection, place a stop loss near recent highs or lows.

4. Risk Management in NVDA Trading

A discussion of how to day trade NVIDIA (NVDA) needs to take account of NVDA’s potential for sharp moves. Robust risk management is crucial. Consider the following guidelines:

Position Sizing: Don’t risk more than 1-2% of your risk capital on any trade. Adjust your position size based on the distance to your stop loss.

Pre-Define Your Stop Loss: Before entering a trade, set a stop loss level where you will exit if the trade moves against you. Stick to this level to avoid excessive losses.

Set Profit Targets: Establish exit points based on technical levels or percentage gains. This prevents you from holding onto winning trades too long, which could lead to reversals and lost profits.

Avoid Over-Trading: High volatility stocks like NVDA can be exciting, but frequent trading increases transaction costs and can lead to impulsive decisions. Stick to your trading plan and avoid trades outside of your strategies.

5. Key Points to Remember When Day Trading NVDA

Stay Updated on News: NVDA is sensitive to industry news and economic reports. Set up alerts for earnings announcements, analyst upgrades or downgrades, and any significant news in the tech or semiconductor sectors.

Trade During High-Volume Hours: For NVDA, the best times to trade are usually within the first and last hours of the market session. Liquidity is higher, and the stock is more likely to exhibit strong trends.

Adapt to Market Conditions: NVDA can trade very differently in a bull versus a bear market. During a bullish trend, focus on buying breakouts and pullbacks. In a bearish trend, short opportunities may present themselves more often.

Final Thoughts on how to day trade NVIDIA (NVDA)

Day trading NVDA can be rewarding, but it requires preparation, discipline, and a clear understanding of technical analysis and risk management. By understanding NVDA’s market behavior, using proven strategies, and managing your risk, you can increase your chances of capturing profitable moves in this dynamic stock. Keep refining your approach, stay updated with market conditions, and always trade with a plan in place.

Good Trading,

Adrian Manz

Trading Range Expansions

Unlocking the Fast Ball Pattern: Trading Range Expansions Created by Institutional Momentum with Targeted Stop-Losses and Targets

When it comes to finding reliable trading setups, the Fast Ball pattern offers a unique opportunity to capitalize on momentum driven by institutional buying or selling. This powerful breakout pattern works by capturing expansion moves that occur after a period of consolidation or a pullback within a trend. Each version of the pattern—whether following a consolidation or a pullback—can reveal the influence of large market players entering or exiting positions with sizable order flow, and that’s where traders can align their trades for high-probability entries and exits.

What is the Fast Ball Pattern?

The Fast Ball pattern signals an opportunity when a stock that has recently consolidated or pulled back within a trend suddenly breaks out with an expansion of both price range and volume. This move is highly significant because it often indicates a large institutional player has made a decisive move, driving demand or supply and creating an imbalance that favors follow-through. Whether day trading or swing trading, the Fast Ball pattern allows traders to catch this momentum as it unfolds.

A consolidation breakout occurs after the stock has spent time moving sideways in a relatively narrow range, with little price movement. A pullback breakout, by contrast, happens after a temporary counter-trend move, where the stock dips or retraces slightly, setting up for a potential bounce. In either case, the breakout from consolidation or the reversal from a pullback represents a market moment where institutions, hedge funds, or other large entities are likely making sizable trades. This influx of capital creates visible price movement and often sustains the stock’s momentum, giving traders a chance to profit.

Market Dynamics at Play

The success of the Fast Ball pattern lies in its ability to pinpoint the moments when institutional forces take action. Institutions often build or unwind positions with careful attention to timing, attempting to execute orders without disrupting market stability. However, when their order flow is substantial enough to move price range and volume sharply, it creates a clear footprint on the daily chart. This expansion day suggests a genuine imbalance in supply and demand, revealing the direction large players are supporting.

When both range and volume spike, it’s more than a simple breakout. It reflects significant institutional interest, which signals to traders that there’s a strong chance for the momentum to continue in the breakout direction. A volume-backed range expansion suggests large capital flow is driving the trend, creating a higher probability of continued movement.

Trading the Fast Ball Pattern

The Fast Ball pattern can be traded with different approaches depending on your style, time frame, and risk tolerance. Here’s how day traders and swing traders can make the most of it:

- Entry and Stops:

- For day traders, the Fast Ball entry should be close to the initial breakout on the expansion day. Stops are best set using intraday support and resistance on that breakout day, allowing for quick entries and exits with a tighter risk profile.

- For swing and position traders, who may hold positions over multiple days, wider stops are suitable. These stops might be set at the low of the breakout day (for long trades) or at the high (for shorts), giving the trade more room to play out within the larger trend and to capture sustained momentum.

- Targets:

- Day traders can establish targets by looking at support and resistance zones on daily charts. These levels often act as near-term barriers, where order flow could potentially satisfy institutional buyers or sellers, leading the expansion move to pause or reverse.

- Swing and position traders may turn to weekly charts to identify broader support and resistance zones. These zones serve as key levels where momentum will likely meet institutional or high-volume order flow, which can end the breakout move. Setting targets at these longer-term levels allows for a bigger profit window but requires patience for the trade to unfold.

- Support and Resistance Levels:

- In both approaches, identifying support or resistance levels where price might encounter opposing order flow is essential. These levels can often act as magnets, drawing price until enough orders are filled to satisfy institutional buying or selling needs. Once these levels are met, the expansion move often slows or reverses, which makes them ideal exit points for traders using this pattern.

Why the Fast Ball Pattern Works

The Fast Ball pattern works because it captures the influence of large players in the market, aligning with their order flow at critical moments. When a stock breaks out of consolidation or a pullback, driven by a notable increase in volume and range, it’s a sign that demand or supply has shifted significantly—typically due to institutional trading. Unlike breakouts driven purely by speculative retail activity, those backed by institutional capital tend to be more reliable, as institutions have both the capital and conviction to see their trades through, which helps sustain the move.

By following the Fast Ball pattern, traders can catch a ride on this institutional momentum, entering at a moment when the setup reveals commitment from large players. While many setups rely on hoping for continued price movement, the Fast Ball is rooted in the dynamics of supply and demand imbalance, offering a high-probability trade entry that is less likely to fizzle out.

Final Thoughts

The Fast Ball pattern offers a roadmap for traders looking to trade with confidence. By focusing on consolidation and pullback breakouts that show clear signs of institutional participation, the setup aligns traders with larger market forces, rather than leaving them vulnerable to random price movement. With disciplined stops and well-chosen targets, day traders can capture quick profits within the day, while swing traders can take advantage of broader market moves by using weekly support and resistance to establish their exit points.

Ultimately, the Fast Ball pattern is about recognizing the signals left by big players in the market and leveraging those signals for gains. By aligning with institutional order flow, traders increase the likelihood of profitable trades and place themselves in sync with market momentum, allowing them to profit from moves that are backed by significant capital. This makes the Fast Ball pattern a cornerstone for any trader looking to make the most of the market’s dynamic forces.

Good Trading,

Adrian Manz

P.S. Join me at the Metastock Traders Conference this week. Click here to register.

The Risks Gamblers Face When Day Trading or Investing in Stocks

A gambling mindset in day trading investing can lead to a downward spiral. Like traditional gambling, day trading offers the allure of fast profits and quick wins, which can become addictive. Without the right mindset and approach, traders and investors who think like gamblers can quickly find themselves in serious trouble. Here, we’ll dive into some of the common issues gamblers face when they enter the stock market and why developing a disciplined, strategy-oriented mindset is essential for success.

1. Impulsive Decision-Making

One of the most significant problems gamblers face is impulsive decision-making. In gambling, a win or loss often comes down to luck, and decisions are often based on gut feelings or hunches. This impulsive approach can be catastrophic in the stock market. Effective trading and investing require research, planning, and a deep understanding of market trends and economic indicators. Relying on intuition or “hot tips” rather than solid analysis leads to risky trades and often substantial losses.

2. Ignoring Risk Management

Gamblers are often focused on the potential reward rather than the possible loss. This mindset leads to a lack of risk management—betting large sums on single trades, neglecting stop-loss orders, and failing to diversify. Without risk management strategies, a single bad trade can wipe out a significant portion of one’s portfolio. Successful traders know that protecting capital is crucial, and they treat risk management as a central part of their strategy, whereas gamblers are often willing to put it all on the line.

3. Chasing Losses

In gambling, there’s a phenomenon known as “chasing losses,” where individuals increase their bets to recoup their previous losses. When gamblers day trade, this same mindset can lead to revenge trading, where they overtrade or take increasingly risky positions to recover lost funds. This approach often leads to mounting losses as emotional decisions replace rational analysis. Successful traders understand that losses are part of the process and instead focus on maintaining consistency and learning from each mistake.

4. Addiction to the Thrill

For many gamblers, the excitement of placing a bet and watching it play out is a significant part of the appeal. With its fast pace and constant movement, day trading can mimic this thrill. However, trading based on excitement rather than calculated decision-making is a quick path to failure. This addiction to the rush of quick gains and losses can lead to a focus on high-risk trades with little regard for long-term success. Experienced traders know that while the stock market can be thrilling, successful trading is about strategy, patience, and discipline rather than excitement.

5. Neglecting Education and Research

A common problem among gamblers is the lack of interest in understanding the odds and probabilities. Similarly, gamblers who turn to day trading or investing often neglect the importance of continuous education and research. They may jump into trades without understanding technical analysis, fundamental analysis, or market trends. The stock market is complex, and without a solid understanding of how it works, even the most enthusiastic trader will likely lose money.

6. Overconfidence and the Illusion of Control

Gamblers often believe they have a certain level of control over random outcomes, which leads to overconfidence. In the stock market, this mindset can manifest as believing in one’s ability to “beat the market” consistently without the necessary tools, strategy, or experience. Overconfidence can lead to reckless decisions, over-leveraging, and excessive risk-taking. Skilled traders understand the importance of respecting the market, acknowledging its volatility, and working with a carefully considered plan.

7. Focusing on Short-Term Gains Over Long-Term Success

Gamblers typically focus on short-term gains, looking for quick wins and immediate returns. This approach doesn’t translate well to the stock market, where sustainable wealth is often built over time. Successful traders and investors understand the value of a long-term perspective, even if they engage in short-term trades. They are disciplined about sticking to their strategies and goals, whereas gamblers are more likely to jump from one high-risk trade to the next, hoping to “get rich quick.”

8. Emotional Trading

Finally, gambling is inherently emotional, and gamblers who trade often bring these emotions into the stock market. Fear, greed, frustration, and excitement can cloud judgment and lead to poor decision-making. Emotional trading, such as panic-selling during a market downturn or holding onto a losing position out of hope, often results in unnecessary losses. Savvy traders work to keep emotions in check and rely on analysis, not feelings, to drive their decisions.

The Path to Success: Trading with a Non-Gambling Mindset

For gamblers looking to succeed in the stock market, a major shift in mindset is essential. Here are some tips for developing a disciplined approach to trading and investing:

- Educate Yourself: Learn about technical and fundamental analysis, market trends, and economic indicators. Knowledge is a trader’s most powerful tool.

- Develop a Trading Plan: Set clear, achievable goals and establish a plan that includes specific entry and exit points, risk management strategies, and limits on how much you’re willing to lose.

- Prioritize Risk Management: Use stop-loss orders, avoid over-leveraging, and diversify your portfolio to protect against significant losses.

- Control Your Emotions: Avoid making trades based on feelings or impulses. Stick to your strategy and remember that successful trading is about consistent gains over time.

- Focus on Long-Term Success: Rather than looking for quick wins, aim to build a sustainable approach that will serve you well in the long run.

- Reflect on Losses: Instead of chasing losses, view them as learning opportunities. Analyze what went wrong and adjust your strategy accordingly.

The stock market offers a world of opportunity, but only for those willing to approach it with the right mindset. By trading with a disciplined, strategy-oriented approach and resisting the impulses that characterize gambling, traders can set themselves up for consistent, long-term success.

Good Trading,

Adrian Manz

November 8, 2024