The Small Cap Swing Trader Alert Archive

Below you'll find The Small Cap Swing Trader setups stacked up and ordered chronologically.Holiday-Week Trading Strategy and Outcomes

Profitable Trading Setups: Learn to Trade Smart

Holiday trading weeks often disrupt the usual flow of the market, introducing lighter volume and unexpected shifts. But even in these quieter conditions, opportunities abound if you know where to look. The key is to adapt, stay focused, and maintain discipline, allowing the market to come to you rather than chasing trades.

One of the biggest mistakes traders make during holiday weeks is overtrading. The temptation to force trades or jump into setups without proper confirmation can lead to unnecessary slippage and poor decision-making. Instead, it’s crucial to exercise patience and wait for the perfect confluence of factors before pulling the trigger.

Confluence is the cornerstone of high-probability trading. It occurs when multiple technical and contextual signals align to confirm a trade’s validity. For instance, a trade might align with support or resistance levels, coincide with a key moving average, and show momentum on higher timeframes. This convergence increases the likelihood of success and helps you filter out lower-quality setups.

Focusing only on the highest-probability trades increases your chances of success and limits risk. Fewer trades mean fewer opportunities for error, which is particularly important when liquidity is thinner than usual.

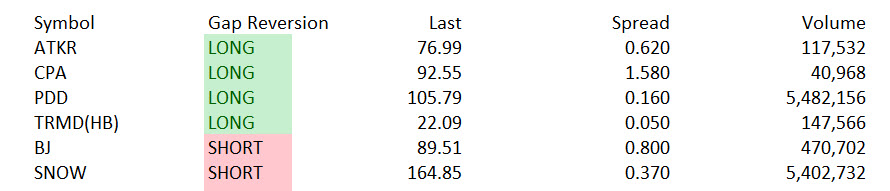

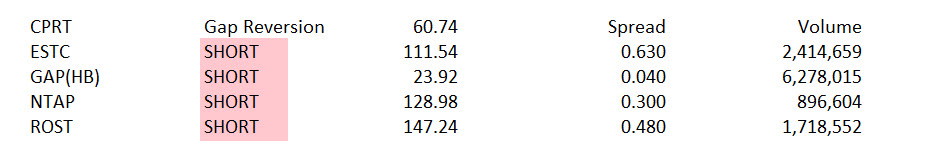

Today’s strategy session demonstrated how this approach works in real time. The first video focused on identifying actionable setups at 2:15 PM ET. The second video showed how those setups unfolded, with strategies that delivered profits—even against light holiday trading.

Here’s what you’ll find in the replay:

1️⃣ Part One: At 2:15 PM ET, I broke down the setups I was tracking, walking you through the key patterns and opportunities the market was offering—even during light holiday trading conditions.

________________________________________________________________________________________________________________________________________________________________________

2️⃣ Part Two: I followed up with a detailed analysis of how those setups played out in real-time. You’ll see how the strategies delivered profits, demonstrating the power of disciplined execution in any market environment.

The lesson is clear: trading during holiday weeks requires a disciplined, focused approach. Don’t let market conditions or emotions dictate your actions. Instead, wait for the market to present ideal opportunities, trade them confidently, and walk away knowing you’ve made calculated intentional decisions.

Click here for more articles and videos.

Good Trading,

Monday’s Economic Report – NAHB Housing Market Index

How the NAHB Housing Market Index Impacts Day Trading Price Action

The NAHB Housing Market Index (HMI) is a key economic indicator that reflects homebuilders’ confidence in the U.S. housing market. Published monthly by the National Association of Home Builders (NAHB) in collaboration with Wells Fargo, the index is derived from a survey of homebuilders. Respondents assess current sales conditions, sales expectations for the next six months, and buyer traffic. The HMI is scored on a scale of 0 to 100, with values above 50 indicating positive sentiment and values below 50 signaling pessimism. Let’s look at the NAHB Housing Market Index’s Impact on the markets and day traders.

Why the NAHB Housing Market Index Matters to Day Traders

The NAHB Housing Market Index can significantly influence the stock market and day trading price action. This indicator often provides early signals about the housing sector’s health—a significant component of the U.S. economy. When the HMI reveals unexpected changes, markets may react swiftly.

For instance, a strong index reading might boost confidence in construction-related stocks, homebuilders, and suppliers, while a weaker-than-expected number could cause these stocks to decline. Additionally, sectors like financials and consumer goods, tied to housing demand, often see increased volatility in response to the data.

How to Trade the NAHB Housing Market Index

Day traders capitalize on the price action triggered by the NAHB Housing Market Index by focusing on key sectors and related indices.

- Prepare in Advance: Know the release schedule and consensus expectations. Platforms like TradingSim can help you simulate trades based on past HMI data.

- Focus on Relevant Stocks: Watch for price moves in homebuilder stocks, ETFs, and construction-related sectors.

- Monitor Broader Market Trends: A surprising HMI result can influence broader indices, especially if it aligns with or contradicts prevailing economic trends.

By understanding how the NAHB Housing Market Index impacts sentiment and market movements, day traders can position themselves for potential opportunities when this key report is released.

Click here for article archives.

Good Trading,

Adrian Manz

Dark Pool Trading

Dark Pools: What They Are and How They Affect Day Trading

In the intricate world of financial markets, dark pool trading and day trading impact remain topics of intrigue and importance for traders of all levels. Dark pools are private, off-exchange trading venues where institutional investors and large players execute large orders discreetly. Unlike public exchanges like NASDAQ or NYSE, these trades do not immediately reflect in the visible market order book, making them “dark” to the rest of the market.

How Dark Pools Work

Dark pools operate to facilitate large transactions with minimal market disruption. For example, if an institutional investor wants to buy a million shares of a stock, executing the order on a public exchange could cause the price to spike due to increased demand. Dark pools help such investors avoid this by allowing the trade to occur outside the public eye.

These platforms often match buy and sell orders internally or route them to other institutional buyers and sellers. While this ensures efficiency for large players, it also means that day traders have limited visibility into the full scope of market activity.

The Impact on Day Trading Price Action

Dark pool trading significantly influences day trading price action, especially for stocks with high institutional interest. Since these trades don’t appear on Level II order books or during normal trading, they can lead to sudden, unpredictable price movements when the information becomes public.

Here’s how dark pool activity can affect day traders:

- Delayed Price Reactions: Large trades in dark pools may affect the market hours later when the information is disclosed, causing abrupt price spikes or drops.

- False Signals: Without visibility into dark pool activity, day traders may misinterpret public market movements, leading to ineffective trades.

- Volatility Surges: When dark pool transactions are reported, they can trigger a chain reaction as algorithms and other traders respond.

For example, a stock may appear stable during the trading session, only for a significant dark pool trade to cause an unexpected breakout or breakdown. Understanding these dynamics is crucial for crafting adaptive trading strategies.

Navigating the Challenges

While dark pools can obscure market transparency, there are ways day traders can adapt:

- Monitor Dark Pool Activity Tools: Services like Level III data or dark pool trade reports can give insight into large institutional activity.

- Leverage Technical Analysis: Recognizing patterns in price action can help anticipate moves related to hidden trades.

- Stay Updated: Keeping track of news and earnings reports can provide context for unusual market movements.

By understanding dark pool trading and day trading impact, traders can make more informed decisions and mitigate the risks of sudden price shocks.

Conclusion

Dark pools are an essential yet elusive part of modern financial markets. While they offer advantages for institutional players, their effects on price action create challenges for day traders. By learning how to interpret market signals in the presence of dark pool activity, traders can better navigate the complexities of intraday movements.

Click here for article archives.

Good Trading

Adrian Manz

Understanding Flash Services PMI and Flash Manufacturing PMI

Understanding Flash Services PMI and Flash Manufacturing PMI:

Economic Insights and Market Impact

The Flash Services PMI and Flash Manufacturing PMI are crucial indicators that provide an early snapshot of economic activity in the services and manufacturing sectors. Released monthly, these Purchasing Managers’ Index (PMI) reports are widely watched by traders, investors, and policymakers for their ability to signal changes in economic growth, inflation, and overall business conditions. Their immediate release often triggers swift reactions in the stock market.

What Do Flash PMI Reports Measure?

- Flash Services PMI

- Focuses on the service sector, which comprises the majority of most advanced economies.

- Tracks metrics such as new business, employment, input prices, and output expectations.

- A reading above 50 signals expansion, while a reading below 50 indicates contraction.

- Flash Manufacturing PMI

- Examines manufacturing activity, offering insights into production, supplier deliveries, inventories, and export orders.

- Like its services counterpart, readings above or below 50 determine whether the sector is expanding or contracting.

What Flash PMIs Tell Us About the Economy

- Economic Growth: Both PMIs reflect real-time conditions in their respective sectors, serving as early indicators of GDP trends.

- Inflation Pressure: Higher input prices in PMI surveys can signal inflationary trends, influencing central bank policy.

- Employment Trends: Employment metrics in PMIs provide clues about labor market strength, which feeds into consumer spending.

How Flash PMIs Impact the Stock Market

The stock market often reacts immediately to Flash PMI releases, especially if they significantly deviate from expectations.

- Readings Above 50 (Expansion)

- Market Impact: Positive. Expanding PMIs signal economic growth, which tends to boost investor confidence. Stocks in cyclical sectors like industrials, technology, and financials often see gains.

- Threshold Example: A Flash Services PMI of 55 or higher might rally consumer-facing companies, while a Flash Manufacturing PMI above 55 could support industrial and materials stocks.

- Readings Below 50 (Contraction)

- Market Impact: Negative. Contraction signals potential economic slowdown, triggering sell-offs in riskier assets. Defensive sectors like utilities and healthcare may outperform in such scenarios.

- Threshold Example: A Flash Manufacturing PMI below 45 may cause sharp declines in manufacturing stocks, suggesting a steep slowdown.

- Mixed Readings

- The market reaction is often sector-specific when one PMI expands and the other contracts. For example, strong services data with weak manufacturing might buoy consumer discretionary stocks while weighing on industrials.

- Surprises Relative to Expectations

- Market participants price in anticipated PMI values ahead of time. Large surprises—such as a PMI significantly higher or lower than consensus—can amplify the market’s reaction.

Key PMI Thresholds to Watch

- Above 60: Signals robust economic growth; often sparks bullish sentiment in equities.

- 50–60: Indicates moderate expansion, supporting stable or slightly positive stock market performance.

- 40–50: A warning zone; markets may show volatility as investors weigh recession risks.

- Below 40: Suggests severe contraction; typically leads to sharp declines in equity markets and increased demand for safe-haven assets.

Conclusion

Understanding what Flash Services PMI and Flash Manufacturing PMI tell us about the economy is vital for traders and investors. These indicators provide early signals about economic health and can drive significant stock market moves immediately after release. By tracking key thresholds and interpreting the reports in the context of market expectations, you can better position your portfolio to capitalize on the opportunities—or mitigate the risks—these reports present.

Click here to read more articles about trading and the economy.

Good Trading,

Adrian Manz

November 22, 2024

Intraday Trading Habits

How a Day Trader Should Prepare for the Trading Day:

Build Strong Intraday Trading Habits

Intraday trading habits

Day trading requires precision, discipline, and a well-defined routine. Success in this high-stakes environment depends on more than just a solid trading strategy—it’s about cultivating intraday trading habits that ensure consistent performance, emotional control, and adaptability to market conditions. Here’s a guide on how day traders can prepare effectively for the trading day and build strong intraday trading habits.

Morning Preparation: Setting the Stage for Success

1. Start with a Clear Mind

- Sleep and Mental Readiness: Ensure you’ve had a good night’s sleep and are mentally alert. Trading requires sharp decision-making, and fatigue can lead to costly mistakes.

- Mindfulness and Focus: Consider practicing meditation or light exercise in the morning to clear your mind and focus your energy.

2. Review Your Trading Plan

- A robust trading plan outlines:

- Entry and exit criteria for trades.

- Risk management rules, including stop losses and position sizes.

- Strategies tailored to specific market conditions (e.g., trending vs. range-bound).

- Revisit your plan to align your actions with your long-term goals and avoid impulsive decisions.

3. Conduct Pre-Market Analysis

- Market News: Review economic reports, corporate earnings, and geopolitical events that could impact the day’s volatility.

- Technical Levels: Identify key support and resistance levels, trendlines, and other technical indicators on your charts.

- Market Sentiment: Analyze pre-market futures and major indices to gauge potential trends or choppiness.

Establishing these morning routines lays the groundwork for effective intraday trading habits that will guide you throughout the session.

Intraday Habits: Staying Disciplined and Focused

1. Stick to a Routine

- Start your trading session with a consistent process, such as reviewing watchlists, adjusting charts, and organizing your trading station.

- A structured routine reduces stress and ensures you’re prepared for opportunities as they arise.

2. Focus on High-Quality Setups

- Avoid the temptation to overtrade. Not every price movement is an opportunity.

- Stick to setups with favorable risk-reward ratios and clear criteria that align with your strategy.

3. Monitor Emotional State

- Trading can be emotionally taxing, especially after a loss or a big win.

- Take regular breaks to reset your focus and avoid impulsive reactions. Use a timer or scheduled alarms to remind yourself to step away from the screen periodically.

4. Maintain a Risk-First Mindset

- Always calculate risk before entering a trade. Never risk more than a predetermined percentage of your capital on any single trade.

- Use stop-loss orders and adhere to them. Never move your stop to accommodate a losing trade.

5. Stay Adaptable

- Markets can change rapidly. If conditions deviate from your expectations, be prepared to reassess your strategy.

- Avoid revenge trading. If the market is not behaving as anticipated, it’s okay to sit on the sidelines.

By focusing on these key intraday trading habits, traders can maintain control and execute their strategies with confidence.

Post-Session Review: Learning from the Day

1. Journal Your Trades

- Record details of every trade, including:

- Entry and exit points.

- The reason for taking the trade.

- Outcome (profit or loss).

- Include notes on emotional state and lessons learned.

2. Analyze Performance

- Look for patterns in your trades. Are certain times of the day more profitable? Are there specific setups or conditions where you consistently succeed or struggle?

- Use these insights to refine your strategy and improve over time.

3. Celebrate Discipline, Not Just Profits

- Acknowledge when you’ve stuck to your plan, even if the trade was a loss. Long-term success in trading is about consistent execution, not just immediate results.

Building Long-Term Habits for Success

1. Consistency is Key

- Make daily preparation, execution, and review a non-negotiable part of your routine. Success in day trading is built over months and years, not days.

2. Continuous Education

- Markets evolve, and so should you. Regularly learn new strategies, refine your techniques, and stay updated on market developments.

3. Emphasize Health and Wellness

- Mental clarity is directly tied to physical health. Maintain a balanced diet, exercise regularly, and prioritize self-care to perform at your best.

4. Stay Connected

- Engage with trading communities or mentors to exchange ideas and gain new perspectives. Having a network can provide accountability and motivation.

Conclusion

Preparation and discipline are the foundations of successful day trading. By establishing a solid morning routine, practicing consistent intraday trading habits, and conducting thorough post-trade reviews, you can navigate the markets with confidence and control. Remember, trading is a marathon, not a sprint. Building strong habits today will lay the groundwork for a profitable and sustainable trading career.

Good Trading,

Adrian Manz

To read more trader education articles, Click Here.

November 21, 2024