The Small Cap Swing Trader Alert Archive

Below you'll find The Small Cap Swing Trader setups stacked up and ordered chronologically.How to Keep a Trading Journal for Success

The Ultimate Guide to Keeping a Trading Journal for Success:

Track, Learn, and Improve

A trading journal is an invaluable tool for any trader seeking consistent growth. Beyond tracking trades, it provides insights into patterns, performance, and psychology, allowing traders to refine their strategies and improve discipline. In this article, you’ll learn how to keep a trading journal for success. At TraderInsight.com, we understand the power of effective journaling, which is why we offer a robust version of our trading journal for the Remarkable 1, 2, and Pro, as well as for iPad, available in our store.

In this article, we’ll dive into the importance of maintaining a thorough trading journal, covering essential fields that help traders learn from every market interaction and continuously enhance their performance.

Why Keep a Trading Journal?

- Accountability: Tracking each trade forces you to take responsibility, highlighting strengths and weaknesses and helping you remain objective.

- Performance Analysis: An effective journal reveals your best strategies and common pitfalls, leading to better trade selection over time.

- Psychological Insight: Trading isn’t just technical; your mental state is crucial to success. Journaling your emotions and thought processes helps identify psychological patterns that could affect your trading.

What to Include in Your Trading Journal

1. Basic Trade Information

- Date: Documenting the trade date is foundational for tracking patterns over time.

- Symbol/Ticker: Clearly identify the stock, future, or other asset involved.

- Position (Long/Short): Noting whether the trade was long or short helps distinguish which trade types are most profitable.

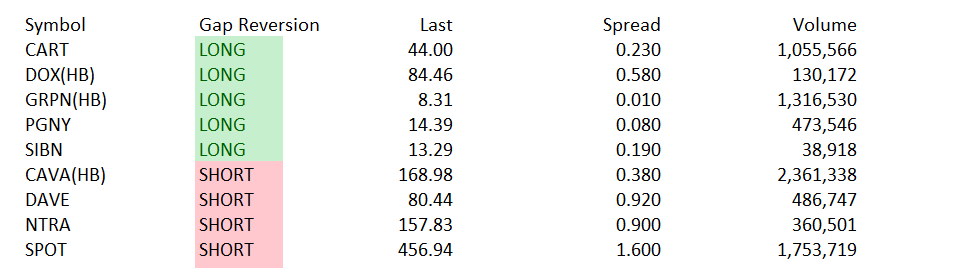

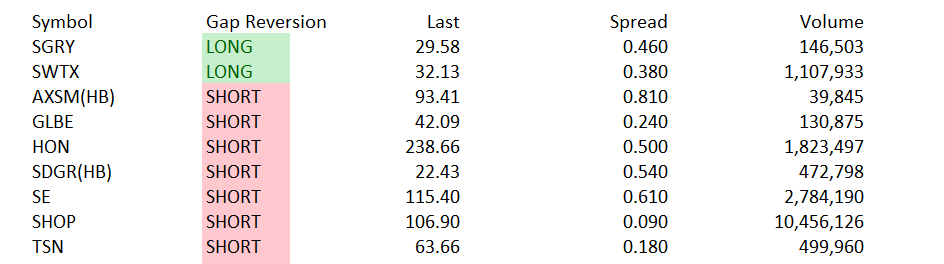

- Setup Type/Pattern: Identify the strategy or chart pattern (e.g., Opening Gap, Magnificent 7), providing insight into which setups work best.

2. Entry and Exit Details

- Entry Price and Time: Capture your entry point and timing to analyze entry effectiveness.

- Exit Price and Time: Record your exit details to review timing precision and adherence to your exit strategy.

- Target and Stop Loss Prices: Include your profit target and stop loss to measure discipline in following the plan.

3. Trade Sizing

- Position Size: Record the number of shares, contracts, or lots.

- Risk per Trade: Track the dollar or percentage risked per trade to assess risk management consistency.

- Risk/Reward Ratio: Document your risk/reward expectations, helping you stay disciplined and focused on high-quality setups.

4. Market Conditions

- Market Direction: Indicate the general market trend (bullish, bearish, neutral) for context.

- Key Economic Events/News: Note relevant events impacting the market, helping you review trades in light of external conditions.

- Sector Performance: Record sector-specific movements that might have influenced the trade.

5. Trade Analysis

- Initial Thesis/Plan: Describe the rationale behind the trade, including technical or fundamental factors.

- Entry Signal: Detail the entry trigger, such as a breakout, for pattern recognition.

- Exit Strategy: Outline the exit plan to ensure you followed the strategy.

- Psychological Notes: Capture your thoughts and mindset before, during, and after the trade for a more complete analysis.

6. Psychological Variables

- Pre-Trade Mood: Track how you felt before starting the trade (e.g., calm, anxious, overconfident).

- Emotional State During the Trade: Document any emotions while the trade was open (e.g., fear of loss, excitement).

- Post-Trade Feelings: Reflect on how you felt afterward, which can highlight if emotions influenced the outcome.

- Self-Talk/Thoughts: Note any internal dialogue that might have impacted decision-making.

- Confidence and Stress Levels: Rate confidence and stress levels, both at entry and exit, for understanding emotional resilience.

- Impulsivity vs. Discipline: Highlight whether the trade followed a disciplined approach or was influenced by impulsive decisions.

- Patience and Focus Levels: Track levels of patience and focus to assess mental clarity.

- Comfort with Risk in this Trade: Did you experience any feelings due to the risk involved in taking the trade.

7. Outcome and Review

- Profit/Loss: Record the net result, allowing you to track progress.

- Trade Grade: Rate how well the trade followed your plan, rewarding disciplined trading.

- Lessons Learned: Note any insights gained to continuously improve.

- Next Steps: Set action items for refining strategies or addressing areas for improvement.

8. Monthly/Quarterly Summary Statistics

- Win Rate: Measure your percentage of successful trades to gauge effectiveness.

- Average Gain/Loss: Track your average results to analyze profitability.

- Most Effective Setups/Strategies: Note which setups yield the best results to optimize your trading focus.

- Biggest Strengths/Weaknesses: Summarize your top strengths and areas for improvement.

Additional Benefits of a Trading Journal

A trading journal is more than a record-keeping tool; it’s a window into your journey and evolution as a trader. By regularly reviewing and analyzing journal entries, you can:

- Spot trends that might otherwise go unnoticed.

- Develop greater mental clarity and discipline.

- Make data-driven decisions, refining your strategies for ongoing improvement.

At TraderInsight Academy, we offer a thoughtfully designed PDF trading journal, specifically formatted for digital devices like the Remarkable 1, 2, and Pro, as well as for iPad. The journal provides space for each of these fields, ensuring you capture every detail of each trade and have a structured way to review your performance and psychology.

A trading journal is the foundation of every successful trader’s routine. By taking a few minutes to complete these fields after each trade, you can transform your trading approach, gaining insights and discipline to meet your goals. Ready to start journaling your way to trading success? Visit TraderInsight Academy and get your own digital trading journal today!

Good Trading,

Adrian Manz

November 13, 2024

November 12, 2024

Mindfulness in Trading

The Importance of Using a Good Trading Simulator When Learning to Trade or Testing New Strategies

Stock Trading Simulators

Learning to trade or developing new strategies requires skill, discipline, and practice. However, practicing in the live market can be risky and costly for beginners or those testing unfamiliar approaches. A high-quality trading simulator offers a solution, providing a safe and effective environment for developing trading skills without risking real money. TradingSim is a favorite among simulators, providing a comprehensive platform for practicing trades, analyzing strategies, and honing trading skills.

1. Why a Trading Simulator is Essential for Beginners

Understanding the fundamentals and building confidence is crucial for new traders. Stock trading simulators replicate live market conditions, allowing users to practice in a controlled, risk-free environment.

Understanding Market Mechanics: Simulators help beginners familiarize themselves with the market and understand how stocks, futures, or forex products behave under various conditions.

Learning Without Financial Risk: Trading in real markets without sufficient experience can lead to significant losses. Simulators allow you to develop skills without financial consequences, making mistakes and learning from them safely.

Building Confidence: New traders often hesitate due to fear of losses. Using a simulator like TradingSim helps build confidence by allowing practice without financial pressure, helping traders develop the self-assurance they need to make decisive moves in live markets.

2. Testing and Refining Strategies in a Risk-Free Environment

For experienced traders, a simulator can be just as valuable when testing or refining new strategies. Market conditions evolve, and having the flexibility to adapt and test approaches is key to staying successful.

Backtesting Historical Data: TradingSim offers access to historical market data, allowing traders to simulate trades in past market conditions. This is invaluable for analyzing a strategy’s performance during different market environments.

Experimenting with New Approaches: A simulator allows you to test various entry and exit points, technical indicators, and risk management strategies without risking real capital. You can assess the performance of each strategy in simulated scenarios and make adjustments as needed.

Improving Decision-Making Speed: Day trading requires quick thinking and making snap decisions. Simulators help you build this skill by repeatedly exposing you to market scenarios so you’ll become faster and more accurate in your live trading.

3. TradingSim: A Top Choice for Simulation

TradingSim is one of the best simulators for traders of all levels. Its unique features make it a standout tool for learning and strategy refinement.

Realistic Market Experience: TradingSim uses real historical data, allowing users to trade as if it were happening live. The platform provides an accurate replication of market movements, enhancing the realism of each trading session.

Customizable Timeframes and Replay Options: One of TradingSim’s standout features is its flexibility in replaying market data. Users can speed up, slow down, or pause the action to analyze and practice at their own pace, making it ideal for learning new techniques.

Comprehensive Charting Tools: TradingSim includes various charting tools and technical indicators, letting traders experiment with different setups and technical analyses. The platform’s visual tools make tracking and understanding market trends easy.

Performance Analytics: TradingSim’s detailed analytics allow you to review each simulated trade’s performance, helping pinpoint improvement areas. You can refine strategies based on actual performance metrics by analyzing your trades.

4. Developing Psychological Resilience in Simulated Environments

Trading psychology is a critical factor in success, and a simulator like TradingSim helps you build the mental discipline required to trade effectively.

Managing Emotions: Fear and greed are two major obstacles for traders. Practicing in a simulator helps you experience the ups and downs of trading without the emotional weight of real financial stakes, allowing you to develop a balanced approach.

Adhering to a Trading Plan: A good simulator encourages you to follow and stick to a trading plan. Practicing in a simulator reinforces the discipline of following your strategy, which is crucial for long-term success.

Handling Losses and Learning from Mistakes: Everyone experiences losses in trading. Simulators provide an opportunity to handle losses in a risk-free way, building resilience and learning lessons that would be costly in real markets.

5. Transitioning from Simulation to Live Markets

While a trading simulator is an excellent tool, transitioning to live trading requires additional considerations.

Gradual Transition: Even if you’ve consistently succeeded in simulation, consider starting small in live markets. The psychological element differs when real money is at stake, so a gradual approach can help bridge the gap.

Review and Adjust: Continue to use TradingSim or similar tools to review trades, experiment, and refine your approach. Simulators can remain vital to your routine, helping you adapt to market shifts and test new ideas.

Maintain a Journal: Whether in a simulator or live trading, keeping a journal of trades can provide insights into what works and what doesn’t. Tracking your thoughts, decisions, and trade outcomes will help reinforce good habits and identify areas for improvement.

Final Thoughts

A high-quality trading simulator like TradingSim is essential for anyone learning to trade or refining their strategies. It provides a risk-free environment for practice, valuable analytical tools, and a platform to hone technical skills and trading psychology. By committing to simulated practice, traders can build a solid foundation, increase their confidence, and ultimately improve their chances of success when they enter live markets. Whether you’re a beginner learning the basics or an experienced trader testing new strategies, using a simulator can be one of the most valuable investments in your trading journey.

Good Trading,

Adrian Manz