The Small Cap Swing Trader Alert Archive

Below you'll find The Small Cap Swing Trader setups stacked up and ordered chronologically.2025 U.S. Tariff Revenue Surges as Deficit Grows

2025 U.S. Tariff Revenue Surges as Deficit Grows: What Traders Need to Know

The 2025 U.S. tariff revenue and deficit numbers are in—and they’re catching the attention of traders, economists, and policymakers alike. Politico said the federal government collected a staggering $46.6 billion in tariffs through May 8, a 46.3% year-over-year increase. This marks a pivotal shift in how the government leverages trade policy to generate revenue.

April Surplus, But a Growing Deficit

Despite a strong April surplus of $258 billion—up 23% from the previous year—the federal deficit for the first seven months of FY 2025 still ballooned to $1.049 trillion, according to Reuters. This paradox—record-high tariff collections alongside a ballooning deficit—raises questions about fiscal sustainability and the broader economic impact of trade restrictions.

How Much Revenue Are Tariffs Bringing In?

Estimates from the Penn Wharton Budget Model suggest that the current tariff policy could yield $5.2 trillion in revenue over 10 years on a static basis, or $4.5 trillion when accounting for economic feedback. These are eye-popping numbers and could theoretically help reduce the long-term deficit if spending remains contained.

But at What Cost?

While the raw numbers are impressive, the costs are equally noteworthy. The same Wharton model forecasts a 6% long-run GDP reduction and a 5% wage drop. For the average middle-income household, the lifetime cost could reach $22,000. This trade-off is critical for market participants, especially those trading consumer-focused or industrial equities impacted by rising input costs and shrinking margins.

Market Implications

Inflation remains a concern. The Consumer Price Index rose 0.3% from March to April, signaling ongoing pricing pressure partly tied to supply chain constraints and higher import costs due to tariffs.

For traders, the 2025 U.S. tariff revenue and deficit dynamic presents both risk and opportunity. Stocks in export-driven sectors, logistics, and manufacturing may face headwinds. Meanwhile, companies able to pass on costs or shift supply chains could outperform.

Key Takeaways for Traders

- Government tariff collections are at their highest in modern history, signaling a shift in fiscal strategy.

- Despite higher revenue, the federal deficit widens, putting long-term pressure on interest rates and economic stability.

- Tariffs are inflationary and contribute to slower GDP growth—factors traders must monitor closely.

- Savvy traders should watch consumer discretionary and industrial names for short-term volatility and long-term dislocation.

For more on trading through macroeconomic shifts, visit our TraderInsight Blog and check out related articles like How Elite Traders Handle Volatility.

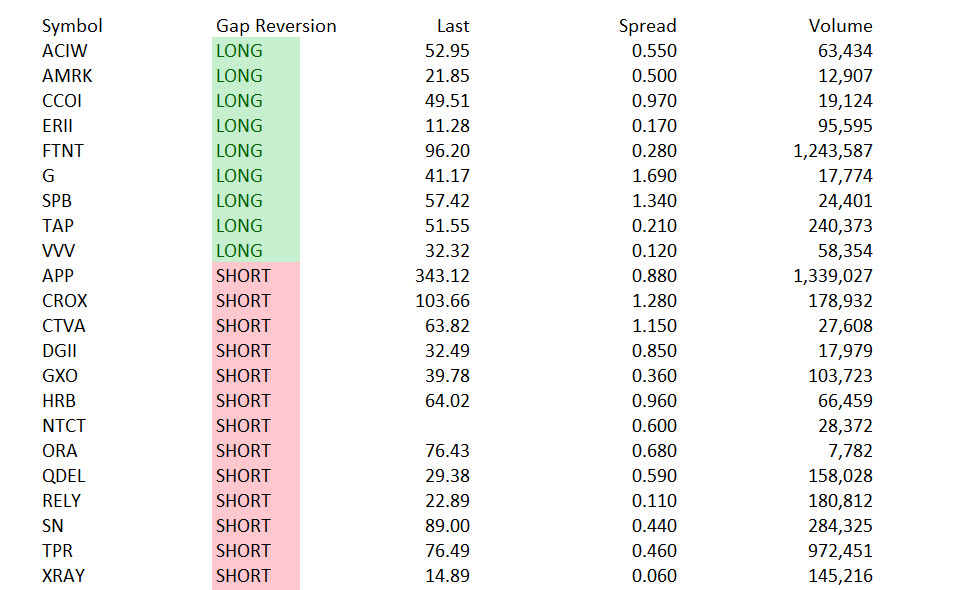

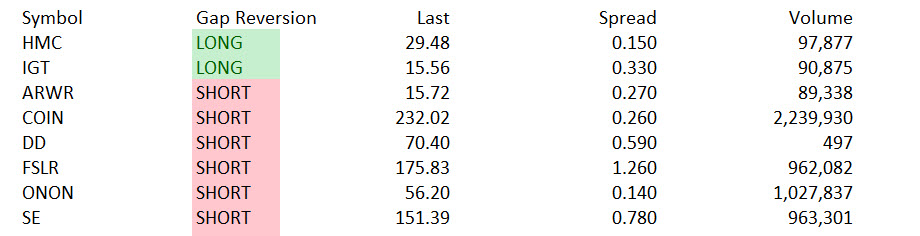

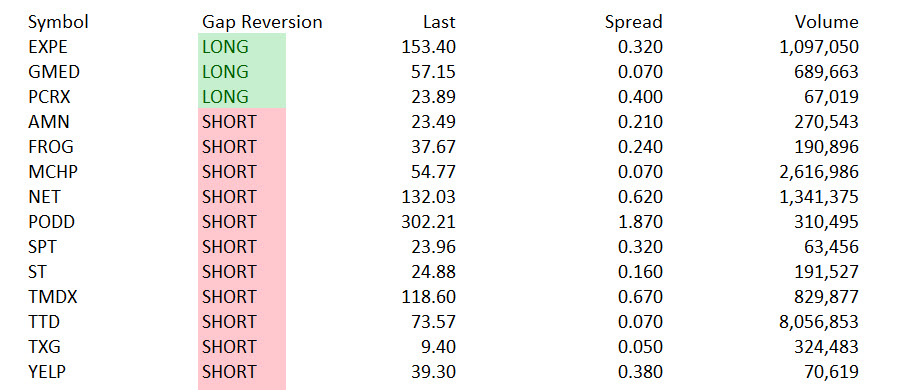

May 13, 2025

May 9, 2025

May 8, 2025