The Small Cap Swing Trader Alert Archive

Below you'll find The Small Cap Swing Trader setups stacked up and ordered chronologically.May 7, 2025

May 6, 2025

Ford suspends guidance due to tariffs

Ford Suspends Guidance Due to Tariffs: $1.5 Billion Cost Forces Strategic Rethink

Ford Motor Co. made headlines today after announcing it is suspending forward financial guidance for 2025, citing a projected $1.5 billion cost from the Trump administration’s new tariff plan. This bold move highlights the mounting pressure American automakers are facing as trade policy once again becomes a dominant market force.

In its latest earnings release, Ford said the sweeping tariffs on Chinese goods, steel, and electric vehicle (EV) components have created “unprecedented uncertainty” in its cost structure and supply chain forecasting. The announcement sent ripples through the auto sector and Wall Street, as Ford’s shares slipped in early trading, and investors began reassessing risk across the board.

This marks the first time since the pandemic that Ford has pulled its guidance mid-year, and the market response has been swift. The key phrase Ford suspends guidance due to tariffs has been echoing across financial news outlets as analysts digest the broader implications.

A Blow to the EV Strategy

One of the tariffs’ most direct impacts is on Ford’s aggressive electric vehicle push. Many EV battery components, rare earth materials, and electronics heavily rely on Chinese suppliers. With tariffs on some goods jumping as high as 100%, the cost structure for Ford’s EV portfolio is no longer tenable under current projections.

Ford’s CFO John Lawler said in a statement, “We are deeply concerned that these tariffs will undermine competitiveness at a critical time in our EV transition.” The company’s electric F-150 Lightning and upcoming models were already battling margin compression, and this new policy introduces even greater hurdles.

Supply Chain Disruption at Scale

Tariffs don’t just raise costs — they disrupt just-in-time inventory models and force companies to re-engineer sourcing strategies. Ford had made significant progress in stabilizing its supply chain following pandemic-era bottlenecks. But the new tariffs could unwind much of that work.

According to the Bloomberg article, Ford executives believe it will take several quarters to fully evaluate alternative sourcing options and adjust pricing across product lines.

What It Means for Investors

The news that Ford has suspended guidance due to tariffs is a red flag for investors who have priced in a rebound in the U.S. auto sector. The S&P Auto Manufacturers Index declined alongside Ford’s stock today, with ripple effects seen in GM, Stellantis, and EV startups like Rivian.

This is a reminder for traders that macro policy shifts can overpower even strong earnings reports. Ford had reported better-than-expected performance in several divisions, yet the market ignored those positives in favor of the larger geopolitical overhang.

Related Reads on TraderInsight

Conclusion

The news that Ford suspends guidance due to tariffs is more than just a corporate headline — it’s a warning shot to industries sensitive to policy-driven cost shocks. With trade tensions back in the spotlight, traders and investors must now recalibrate expectations for cyclical sectors like automotive manufacturing. Ford’s $1.5 billion warning could be just the beginning.

Apple Earnings Disappointment Sends Stock Lower Despite Revenue Beat

Apple Earnings Disappointment Sends Stock Lower Despite Revenue Beat

Apple earnings disappointment was the headline takeaway after the tech giant released its fiscal Q2 results yesterday. Despite beating Wall Street’s top-line expectations, shares of Apple (AAPL) dropped in after-hours and continued lower during Friday’s session. The culprit? Weak iPhone sales and soft guidance that fell short of investor hopes.

Apple Beats on Revenue, But Misses Where It Matters

According to CNBC’s earnings report, Apple reported revenue of $90.8 billion, slightly ahead of consensus estimates. However, the company reported a 10% year-over-year decline in iPhone sales, which make up over half of its total revenue. Services revenue grew by 14%, which was a bright spot, but it wasn’t enough to offset concerns over hardware performance.

The disappointment in Apple’s earnings is largely tied to this contraction in hardware growth, particularly as competitors in China continue to chip away at the iPhone market share. While CEO Tim Cook cited strong performance in emerging markets and expressed confidence in the upcoming product pipeline, investors were clearly hoping for more robust signs of a turnaround.

Forward Guidance Raises Red Flags

Another factor contributing to Apple’s earnings disappointment was the company’s forward guidance. Apple provided vague commentary about the current quarter, suggesting only a “slight improvement” in year-over-year revenue. That lukewarm outlook signaled to traders that the near-term upside might be limited, particularly with macroeconomic headwinds like inflation and shifting consumer behavior still in play.

Morgan Stanley and Goldman Sachs Analysts trimmed their price targets in response to the guidance, adding more downward pressure on the stock. Despite Apple’s largest-ever $110 billion share buyback authorization, the market viewed this as a defensive move rather than a catalyst for renewed growth.

How Traders Are Responding

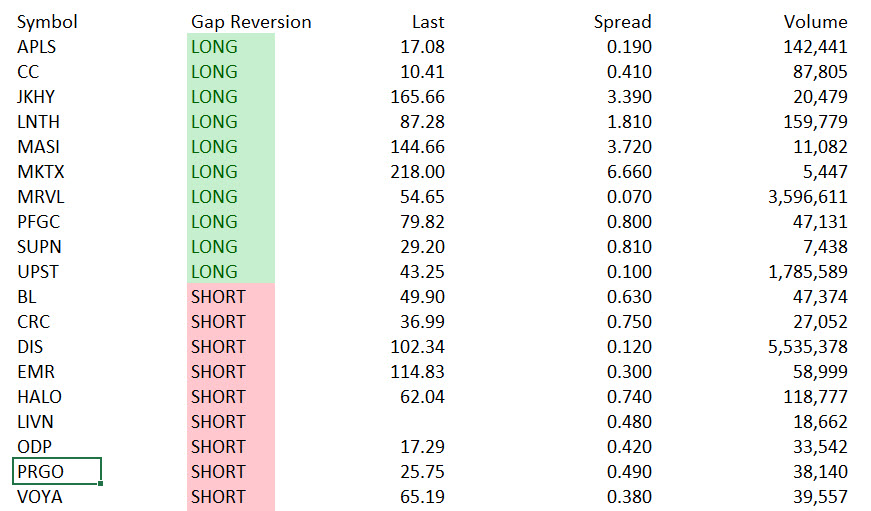

In the TraderInsight War Room, immediate downside setups emerged right at the open. Apple traded below the VWAP and continued to reject intraday resistance zones. Several traders used volatility band reversals and opening gap reversion strategies to short the stock successfully within the first hour of the session.

Yesterday’s live stream webinar also touched on using confidence intervals to fade post-earnings overreactions—a tactic that played out perfectly in AAPL. The Apple earnings disappointment was a textbook example of sentiment-driven price action decoupling from fundamentals.

What to Watch Going Forward

In the future, traders will watch for signs of stabilization around the $170 level, a key technical support since March. If that level fails, the next support sits near $165, which aligns with a 2SD deviation from the mean on the daily chart.

Longer-term investors may need a meaningful uptick in hardware sales or new product announcements—potentially in the AI or AR/VR—to reignite bullish momentum. Until then, expect continued volatility and headline-driven movement.

Related Posts from TraderInsight:

The Apple earnings disappointment reminds us that even the biggest names in tech aren’t immune to market skepticism. For active traders, that spells opportunity—especially when paired with a plan like the ones we teach at TraderInsight.

May 2, 2025