The Small Cap Swing Trader Alert Archive

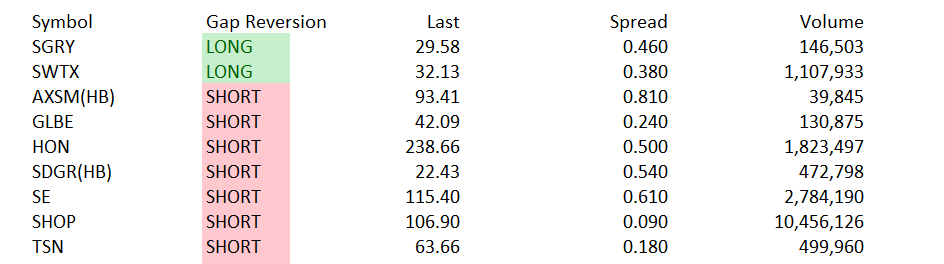

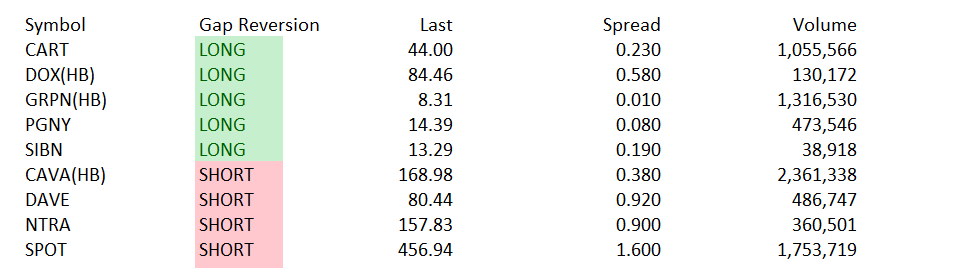

Below you'll find The Small Cap Swing Trader setups stacked up and ordered chronologically.How overnight foreign markets impact the U.S. market open

Interpreting the Overnight Foreign Markets

and Their Impact on the U.S. Market and Day Trading

When the sun sets over Wall Street, global markets continue trading, generating crucial data that can influence U.S. market performance and day trading strategies. By analyzing overnight activity in Asian and European markets, traders can glean insights into potential U.S. market movements and adjust their day trading strategies accordingly. This article outlines the key elements to watch to determine how overnight foreign markets impact the U.S. market open and how U.S. traders should prepare for the trading day ahead.

1. The Influence of Asian Markets

Asian markets, particularly those in Japan, China, and South Korea, are among the first to open after the U.S. market closes. The Nikkei 225 in Japan, the Shanghai Composite in China, and the KOSPI in South Korea are influential indices. Due to their significance in the manufacturing, technology, and energy sectors, these markets often set the tone for global sentiment.

Japanese Markets: The Nikkei 225 reflects the performance of major Japanese companies, many of which are heavily involved in the global tech and automotive industries. A rally in Japanese markets, particularly driven by technology stocks, can suggest optimism in the global tech sector and could result in a positive sentiment spillover into U.S. tech stocks.

Chinese Markets: The Shanghai Composite is essential for traders because of China’s economic influence. Economic data releases—such as GDP growth rates, export figures, and government policy announcements—can signal shifts in commodity demand, affecting stocks in the U.S. mining, agriculture, and energy sectors. For example, weak economic data from China may dampen U.S. stocks with heavy exposure to China.

Currency Fluctuations: The USD/JPY exchange rate is also a critical indicator. For example, a strong yen against the dollar can impact Japanese export-heavy companies, creating fluctuations that might predict similar behavior in U.S. stocks with significant export components.

2. Key Indicators from European Markets

The European markets open before U.S. trading, providing the final overseas cue for U.S. market sentiment. The FTSE 100 (UK), DAX (Germany), and CAC 40 (France) are major indices worth analyzing.

European Sentiment and U.S. Futures: European indices often correlate with the U.S. futures market, providing an early preview of how the S&P 500, Dow, and Nasdaq may open. A strong European session, supported by robust earnings or favorable economic data, often translates to positive U.S. futures.

Energy and Commodity Prices: Europe’s reliance on imported energy makes it particularly sensitive to oil and natural gas price changes. Energy stocks in the U.S. may react in anticipation of European demand trends. For instance, a spike in European natural gas prices might boost energy stocks in the U.S. as traders anticipate increased global demand.

Policy Announcements: The European Central Bank (ECB) and Bank of England (BoE) regularly make policy announcements early in the European trading day. For example, a dovish stance from the ECB may weaken the euro, resulting in a stronger dollar. This, in turn, can impact U.S. exporters, as a stronger dollar makes American goods more expensive overseas.

3. Futures Markets and Volatility

U.S. futures are among the best tools for assessing the impact of overnight trading. Futures contracts for the S&P 500, Nasdaq 100, and Dow Jones Industrial Average trade for almost 24 hours, allowing traders to monitor market sentiment as it evolves.

Tracking Overnight Futures Movement: Futures often mirror foreign market performance, providing a sneak peek into potential market sentiment at the U.S. open. If S&P 500 futures are trading higher during European hours, it often indicates positive sentiment that may carry over into the opening bell.

The Role of Volatility Indices: The VIX, often called the “fear index,” can signal anticipated market turbulence. When overnight trading experiences sharp price swings, the VIX may spike, warning day traders of increased volatility and encouraging them to prepare for rapid price changes at the open.

4. Economic Data Releases and Global News Events

Overnight, various foreign governments release economic data that can move markets. For instance, Chinese trade data, European industrial production, or Japanese inflation numbers are released while U.S. markets are closed, influencing global sentiment.

Sector-Specific Influences: Certain data points disproportionately affect specific sectors in the U.S. For instance, European PMI data often influences industrials and manufacturing stocks, while Chinese consumer data impacts U.S. retail and technology companies. U.S. traders should align overnight economic data with sectors that tend to react most strongly to that information.

Global News Events: Geopolitical news can create swift overnight shifts. For instance, unexpected announcements related to tariffs, trade agreements, or conflicts can immediately affect global markets and set the tone for U.S. trading.

5. Day Trading Strategies Based on Overnight Market Analysis

Interpreting overnight markets helps day traders position themselves effectively for the morning session. Here are several strategies that leverage insights from foreign markets:

Pre-Market Gap Analysis: By assessing the impact of overnight market movement, day traders can look for gap opportunities. If futures open with a significant gap due to strong Asian and European market performance, day traders might seek continuation patterns at the open or prepare to short if they expect a retracement.

Sector Rotation: When overnight activity favors certain sectors (e.g., tech in Asia or energy in Europe), day traders can prioritize trades in U.S. sectors likely to react to those global cues.

Event-Based Trading: Economic announcements or geopolitical news influencing overnight markets can lead to volatility in related U.S. stocks. Day traders can focus on stocks or ETFs in sectors directly impacted by these events, using chart patterns or momentum indicators for timely entries and exits.

Psychological Indicators and Market Sentiment: By observing shifts in global sentiment, traders can gauge market psychology. If sentiment is negative abroad due to economic concerns, traders may approach the U.S. open with caution, setting tighter stop losses or taking smaller position sizes.

Conclusion

Overnight foreign markets are vital to understanding potential U.S. market movements. By tracking key indices, futures, and economic data from Asia and Europe, traders can interpret shifts in global sentiment and position themselves to make informed day trading decisions. While overnight market activity doesn’t guarantee a particular outcome for the U.S. market, analyzing these trends offers day traders an edge, helping them anticipate potential market directions and prepare for a profitable day ahead.

Good Trading,

Adrian Manz

AMD Announces Workforce Reduction Amid AI Focus

Advanced Micro Devices (AMD) announced plans to reduce

its global workforce by approximately 4%, equating to nearly 1,000 employees.

On November 13, 2024, Advanced Micro Devices (AMD) announced plans to reduce its global workforce by approximately 4%, equating to nearly 1,000 employees. In many minds, It amounts to an announcement by the company that AI eliminates jobs. But this strategic move aims to reallocate resources toward high-growth areas, particularly in artificial intelligence (AI) chip development, as AMD intensifies its competition with industry leader Nvidia.

The decision follows AMD’s recent financial disclosures, which revealed a mixed performance across its business segments. The data center unit experienced a significant revenue increase, more than doubling in the September quarter, driven by robust demand for AI graphics processors. Conversely, the gaming division faced a substantial 69% decline in sales during the same period. To capitalize on the burgeoning AI market, AMD plans to mass-produce its MI325X AI chip in the fourth quarter despite the increased research and development expenses.

In response to the layoff announcement, AMD’s stock declined, closing at $140.66, down 2.1% on Wednesday. This downturn contributes to a year-to-date decrease of approximately 4.54%, contrasting with the S&P 500’s 26% gain over the same period.

Looking ahead to Thursday’s market session, investors are likely to closely monitor AMD’s stock performance, assessing the potential long-term benefits of the company’s strategic focus on AI against the immediate impact of workforce reductions. The broader semiconductor sector may also experience heightened volatility as market participants evaluate the implications of AMD’s restructuring on industry dynamics and competitive positioning.

How to Keep a Trading Journal for Success

The Ultimate Guide to Keeping a Trading Journal for Success:

Track, Learn, and Improve

A trading journal is an invaluable tool for any trader seeking consistent growth. Beyond tracking trades, it provides insights into patterns, performance, and psychology, allowing traders to refine their strategies and improve discipline. In this article, you’ll learn how to keep a trading journal for success. At TraderInsight.com, we understand the power of effective journaling, which is why we offer a robust version of our trading journal for the Remarkable 1, 2, and Pro, as well as for iPad, available in our store.

In this article, we’ll dive into the importance of maintaining a thorough trading journal, covering essential fields that help traders learn from every market interaction and continuously enhance their performance.

Why Keep a Trading Journal?

- Accountability: Tracking each trade forces you to take responsibility, highlighting strengths and weaknesses and helping you remain objective.

- Performance Analysis: An effective journal reveals your best strategies and common pitfalls, leading to better trade selection over time.

- Psychological Insight: Trading isn’t just technical; your mental state is crucial to success. Journaling your emotions and thought processes helps identify psychological patterns that could affect your trading.

What to Include in Your Trading Journal

1. Basic Trade Information

- Date: Documenting the trade date is foundational for tracking patterns over time.

- Symbol/Ticker: Clearly identify the stock, future, or other asset involved.

- Position (Long/Short): Noting whether the trade was long or short helps distinguish which trade types are most profitable.

- Setup Type/Pattern: Identify the strategy or chart pattern (e.g., Opening Gap, Magnificent 7), providing insight into which setups work best.

2. Entry and Exit Details

- Entry Price and Time: Capture your entry point and timing to analyze entry effectiveness.

- Exit Price and Time: Record your exit details to review timing precision and adherence to your exit strategy.

- Target and Stop Loss Prices: Include your profit target and stop loss to measure discipline in following the plan.

3. Trade Sizing

- Position Size: Record the number of shares, contracts, or lots.

- Risk per Trade: Track the dollar or percentage risked per trade to assess risk management consistency.

- Risk/Reward Ratio: Document your risk/reward expectations, helping you stay disciplined and focused on high-quality setups.

4. Market Conditions

- Market Direction: Indicate the general market trend (bullish, bearish, neutral) for context.

- Key Economic Events/News: Note relevant events impacting the market, helping you review trades in light of external conditions.

- Sector Performance: Record sector-specific movements that might have influenced the trade.

5. Trade Analysis

- Initial Thesis/Plan: Describe the rationale behind the trade, including technical or fundamental factors.

- Entry Signal: Detail the entry trigger, such as a breakout, for pattern recognition.

- Exit Strategy: Outline the exit plan to ensure you followed the strategy.

- Psychological Notes: Capture your thoughts and mindset before, during, and after the trade for a more complete analysis.

6. Psychological Variables

- Pre-Trade Mood: Track how you felt before starting the trade (e.g., calm, anxious, overconfident).

- Emotional State During the Trade: Document any emotions while the trade was open (e.g., fear of loss, excitement).

- Post-Trade Feelings: Reflect on how you felt afterward, which can highlight if emotions influenced the outcome.

- Self-Talk/Thoughts: Note any internal dialogue that might have impacted decision-making.

- Confidence and Stress Levels: Rate confidence and stress levels, both at entry and exit, for understanding emotional resilience.

- Impulsivity vs. Discipline: Highlight whether the trade followed a disciplined approach or was influenced by impulsive decisions.

- Patience and Focus Levels: Track levels of patience and focus to assess mental clarity.

- Comfort with Risk in this Trade: Did you experience any feelings due to the risk involved in taking the trade.

7. Outcome and Review

- Profit/Loss: Record the net result, allowing you to track progress.

- Trade Grade: Rate how well the trade followed your plan, rewarding disciplined trading.

- Lessons Learned: Note any insights gained to continuously improve.

- Next Steps: Set action items for refining strategies or addressing areas for improvement.

8. Monthly/Quarterly Summary Statistics

- Win Rate: Measure your percentage of successful trades to gauge effectiveness.

- Average Gain/Loss: Track your average results to analyze profitability.

- Most Effective Setups/Strategies: Note which setups yield the best results to optimize your trading focus.

- Biggest Strengths/Weaknesses: Summarize your top strengths and areas for improvement.

Additional Benefits of a Trading Journal

A trading journal is more than a record-keeping tool; it’s a window into your journey and evolution as a trader. By regularly reviewing and analyzing journal entries, you can:

- Spot trends that might otherwise go unnoticed.

- Develop greater mental clarity and discipline.

- Make data-driven decisions, refining your strategies for ongoing improvement.

At TraderInsight Academy, we offer a thoughtfully designed PDF trading journal, specifically formatted for digital devices like the Remarkable 1, 2, and Pro, as well as for iPad. The journal provides space for each of these fields, ensuring you capture every detail of each trade and have a structured way to review your performance and psychology.

A trading journal is the foundation of every successful trader’s routine. By taking a few minutes to complete these fields after each trade, you can transform your trading approach, gaining insights and discipline to meet your goals. Ready to start journaling your way to trading success? Visit TraderInsight Academy and get your own digital trading journal today!

Good Trading,

Adrian Manz

November 13, 2024

November 12, 2024