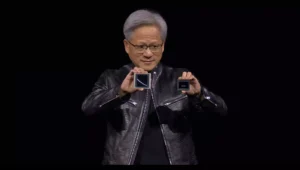

Nvidia Earnings Impact on AI Stocks: What Traders Need to Know

Nvidia’s Q4 2025 earnings report delivered record-breaking revenue, yet NVDA earnings sent shares lower in late after-hours trading. Despite reporting a 78% revenue surge to $39.33 billion and net income of $22.06 billion, the stock slipped 1% post-market. What does this mean for traders and the broader AI sector? Let’s dive into the details.

Nvidia’s Q4 2025 Earnings Breakdown

- Revenue: $39.33 billion, up 78% year-over-year

- Net income: $22.06 billion

- Data center sales: Up 93% to $35.6 billion

- Forecast: Q1 2026 revenue guidance at $43 billion, slightly above expectations

Despite these impressive numbers, Nvidia earnings impact on AI stocks was evident as NVDA stock declined in late trading.

Why Did NVDA Stock Drop After Earnings?

1. High Expectations Priced In

Nvidia exceeded forecasts, but traders had priced in even higher growth. AI-driven momentum stocks often experience selloffs after earnings if results fail to outpace expectations significantly.

2. Growing AI Competition

Companies like DeepSeek are developing competitive AI models that don’t require Nvidia’s expensive GPUs. This raises concerns about long-term dominance in the AI chip sector.

3. Geopolitical and Tariff Risks

Potential U.S.- China trade restrictions could impact Nvidia’s supply chain and sales in key markets. Investors are cautious about how these developments could shape the Nvidia earnings impact on AI stocks in the future.

Market Reaction: What’s Next for AI Stocks?

Nvidia’s earnings impact on AI stocks extends beyond NVDA itself. Traders should watch how competitors like AMD, Intel, and AI-focused cloud firms react. Depending on broader tech sentiment, a short-term pullback in Nvidia could present buying opportunities.

Trading Strategies for Nvidia Earnings Volatility

- Look for Dip-Buying Opportunities: Nvidia has a history of post-earnings pullbacks followed by rebounds.

- Watch for Institutional Buying Levels: Monitor volume spikes for potential support zones.

- Consider Sector Rotation: If AI stocks face selling pressure, money could rotate into undervalued tech names.

Click here to read more at Bloomberg.com

Conclusion

The impact of the announcement highlights the high-stakes nature of the AI-driven rally. While long-term demand for AI chips remains strong, competition, macro risks, and lofty expectations create short-term volatility. Traders should stay agile, leveraging technical and fundamental analysis to navigate market moves.

What’s your take on Nvidia’s earnings? Drop your thoughts in the comments below!