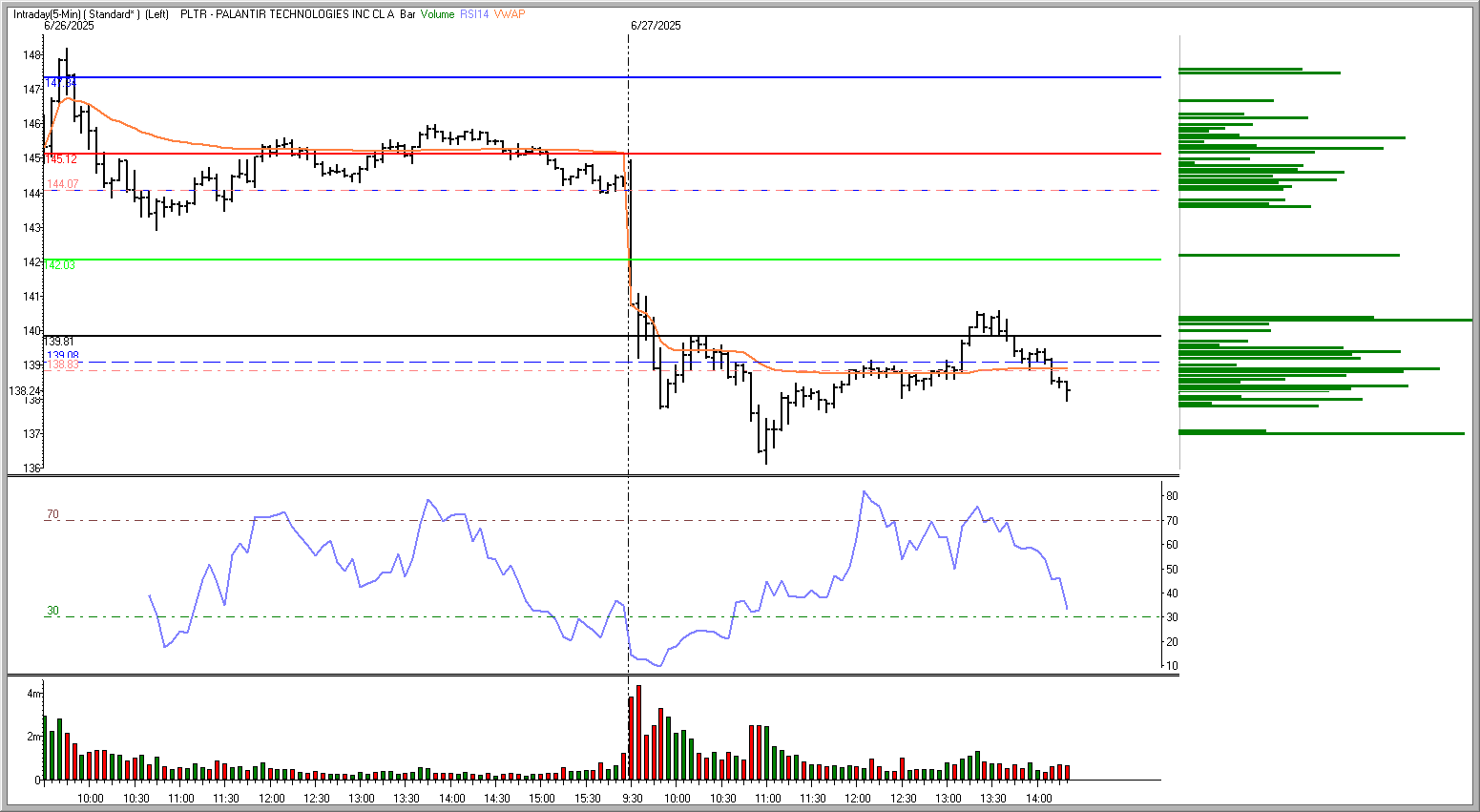

PLTR Trade Breakdown: A Short Setup Backed by Pivot Resistance, VWAP Reversion, and RSI Divergence

June 27, 2025

Today’s short in Palantir Technologies (PLTR) was a textbook intraday setup that brought together multiple high-probability signals. From pivot rejection to RSI divergence and VWAP targeting, the trade aligned market psychology and technical structure — offering a clean, risk-defined opportunity late in the session.

Trade Summary

-

Ticker: PLTR (Palantir Technologies)

-

Entry: Short at 139.78 (stop-limit order)

-

Time of Entry: 13:45 ET

-

Target: 139.08 (just above VWAP)

-

Tools Used: Pivot Points, VWAP, RSI (14), Volume-by-Price

The Setup Explained

🧭 Pivot Level Rejection

The S1 pivot level at 139.81 acted as a key resistance point. Price made a higher high into that level just before 13:45 but failed to break through meaningfully. This behavior indicated buying exhaustion, making it a prime location for a short entry, especially when other indicators supported a downside reversal.

🪞 Bearish RSI Divergence

Here’s what made the short especially compelling: as price made that higher high, the 14-period RSI made a lower high, forming a clear bearish divergence. Additionally, the RSI was rolling down through 70, indicating that the prior overbought condition was unwinding and momentum was fading.

This divergence is often one of the most reliable reversal signals when confirmed by price structure, and in this case, the failure at S1 made it actionable.

🎯 VWAP as a Target

The VWAP (Volume Weighted Average Price) sat around 139.08, offering a clear reversion magnet. In the afternoon, especially on reversal setups, VWAP tends to act as a gravitational pull for price, particularly after failed rallies.

Placing the target just above VWAP ensured a realistic exit and kept the trade out of the noise of potential mid-range chop.

📊 Volume-by-Price Void

The Volume-by-Price profile exhibited light participation between 139.60 and 139.10, creating a low-resistance pathway for the price to move quickly once it failed to hold below the S1 pivot.

A dense volume shelf was positioned near VWAP, indicating that supply would likely return to that zone. This made it the logical target — and further validated the decision to exit before buyers regrouped.

Execution Detail

At 13:45 ET, a stop-limit short at 139.78 was triggered as the price rolled over from the S1 pivot rejection. Momentum quickly shifted, and the price moved smoothly down toward the VWAP, achieving the exit at 139.08 with a limited drawdown.

This was a low-risk, high-conviction trade — the kind that forms when structure and psychology align.

Key Lessons and Takeaways

| Indicator | Insight | Role in the Trade |

|---|---|---|

| Pivot Points | S1 acted as resistance | Defined entry zone |

| RSI Divergence | Price ↑, RSI ↓ | Early warning of reversal |

| VWAP | Below S1 | Target and mean reversion anchor |

| Volume-by-Price | Light volume pocket | Gave room for clean move |

Conclusion

This PLTR trade exemplifies how RSI divergence, particularly when combined with pivot resistance and VWAP proximity, can provide razor-sharp intraday opportunities. Combined with volume profile clarity, it offered not just a strong entry but also a logical and highly probable exit.

Whether you’re actively trading or reviewing your own setups, this is a perfect example of how blending momentum, price structure, and volume logic can improve your edge.