The Psychology of Jumping the Gun in Trading

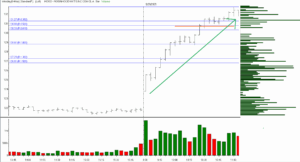

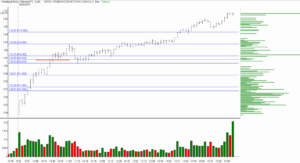

A friend and fellow trader called me on Monday and asked me to look at the chart of Robin Hood (HOOD) and “explain why the short was losing money.” I responded as I have many times in the past: if it were me, I would be waiting for a pullback to support and resistance at the Fibonacci confluence. Then, I’d take a long position in the direction of the trend.

He didn’t wait for the pullback. Instead, he entered long at the swing high and stopped out on the way down to the exact confluence of indicators that would have triggered a long entry by my rules. To make matters worse, he convinced himself that the drop proved he was “right all along” about the short—just before the stock reversed, ripped higher, and hit the logical profit objective.

Waiting for price to “come in” and reach the opportunity of confluence increases the odds of success dramatically.

Sound familiar? If so, you’re not alone. I’ve made the same mistake myself. Sometimes the urge to outsmart the market during an extreme move is irresistible. Unfortunately, markets can remain overbought or oversold far longer than we expect. Tops and bottoms often call to traders like sirens from the cliffs, and no number of wrecked accounts seems to silence the song. This is where trading psychology and premature entries collide.

Why We Do It

At the root of this behavior is a cocktail of fear of missing out (FOMO) and the illusion of control. When price makes a sharp move, our brains start running “what if” scenarios at lightning speed:

-

“If I don’t get in now, I’ll miss it.”

-

“It’s moved too far, so it must turn around.”

-

“I see something others don’t.”

Each of these thoughts feels logical in the moment but is fueled by emotion, not analysis. Worse, when we’re occasionally correct—catching the top or bottom once in a while—it reinforces the behavior. The brain remembers the win more vividly than the string of losses that came before and after. That’s why trading psychology and premature entries often go hand in hand.

The Hidden Risk of Being Right Sometimes

The most dangerous outcome isn’t losing a trade. It’s winning the wrong way. Being “right” on a reckless entry wires the brain to crave that high again, pushing traders to repeat the mistake with bigger size or less discipline. Over time, this creates a destructive cycle: chasing the rush instead of following the plan. Understanding trading psychology and premature entries is the first step toward breaking this cycle.

Breaking the Cycle

So how do you stop yourself from getting lured into the rocks?

✅ Anchor to process, not price.

Your edge lives in repeating setups with statistical validity. Write down your entry criteria and do not deviate.

✅ Use waiting as a tactic.

Tell yourself: “If it’s a true opportunity, it will come back to my level.” Patience is an action.

✅ Practice mental rehearsal.

Visualize watching a move run without you and feeling calm. Rehearsal reduces FOMO in live fire.

✅ Track your “impatience trades.”

Journal every time you enter too soon. The pattern—often embarrassing—creates the pressure you need to change.

Disciplined routines directly counteract the pull of trading psychology and premature entries that lead so many traders astray.

Final Thoughts

The HOOD chart was a perfect example: the market offered a clear, logical profit objective, but only to those who had the discipline to wait. Trading is rarely about outsmarting others. More often, it’s about outsmarting yourself. The sirens will always sing, but with the right preparation and mindset, you can steer safely past them—while others shipwreck on the rocks. The choice is yours: fall prey to trading psychology and premature entries, or master the discipline that keeps you in control.