Amazon Tariff Price Display Sparks Political Clash

In a move that reignited political tensions, the idea of an Amazon tariff price display has set off a high-profile spat between the e-commerce giant and the White House. On April 29, 2025, CNBC reported that the Trump administration lashed out at Amazon after a leaked internal discussion suggested the company might show U.S. tariffs as line-item charges on certain product listings. Though Amazon later clarified that the plan was limited to internal discussions for its Haul storefront and was never implemented, the political firestorm had already ignited.

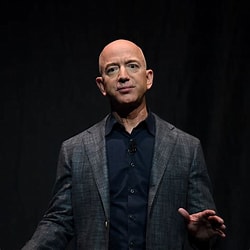

White House Reaction and Bezos Response

White House Press Secretary Karoline Leavitt condemned the Amazon tariff price display as a “hostile and political act,” suggesting it was designed to turn public opinion against current tariff policies. President Donald Trump reportedly called Amazon founder Jeff Bezos personally to express his anger, calling the idea inflammatory during a sensitive economic period. Following the call and Amazon’s public clarification, Trump issued a statement thanking Bezos for “putting the issue to rest.”

Other Retailers Quietly Watching

Behind the scenes, major retailers like Walmart, Target, and Best Buy are reportedly evaluating similar pricing transparency moves. While none have gone public, several analysts suggest that retailers are feeling squeezed by increasing import costs, especially in electronics and home goods. The consideration of an Amazon tariff price display has opened the door for other large-scale sellers to rethink how tariffs are communicated to consumers.

This reflects growing unease among U.S. businesses about the ripple effects of extended tariff enforcement, particularly if the cost burden is increasingly borne by consumers. According to Peterson Institute for International Economics, U.S. consumers have paid billions in additional costs since the start of the U.S.-China trade war.

Possible New Trade Deal on the Horizon

Interestingly, this controversy comes amid new reports that the White House may be close to finalizing a new trade agreement with China. While details remain vague, administration officials have hinted at a framework that could reduce tariffs on a range of consumer goods if China agrees to improved IP enforcement and stricter carbon commitments in manufacturing.

This potential deal could undercut the need for companies like Amazon to consider a tariff price display at all—though the policy uncertainty has already prompted some internal shifts in how product margins are evaluated.

What It Means for Traders and Investors

From a trading perspective, the Amazon tariff price display flap highlights how geopolitical and policy risks continue to drive volatility in the consumer discretionary sector. Stocks like AMZN, WMT, and TGT may be subject to sharp intraday swings as headlines break, creating both risk and opportunity for short-term traders. For more analysis of trading through economic news, visit past coverage:

- Trading the Tariff Tape: How Traders React to Trade Policy Headlines

- Inflation and the Opening Range: Navigating Choppy Starts

- Market Maker Moves Amid Political Noise

Conclusion

The Amazon tariff price display episode may have ended with a press release and a presidential thank-you, but it signals broader tension between corporate America and U.S. trade policy. As the White House negotiates new international agreements, and retailers face mounting pressure from rising costs, transparency in pricing may become a flashpoint again. For traders, this creates a vital area to watch—not just for the headlines, but for how they shape market momentum and sector rotation.