Forgotten Profits Trade Setup Archive

Below you'll find Ian's setups stacked up and ordered chronologically. As this service once resided at another home, the alerts only go back to mid July. For a full track record, see the portfolio.Scaling Into Trades

Smarter Lot Sizing: How Scaling Into Trades Improves Consistency

One of the most overlooked skills in trading is scaling into trades. Many traders either go all-in at their first entry point or wait too long, missing the best opportunities. But by learning how to adjust lot sizing based on confidence levels, you can dramatically improve your results.

Why Scaling Matters

When you’re scaling into trades, the first position is smaller because your confidence is lower at that early stage. You’re not trying to pick tops and bottoms—you’re simply giving yourself a chance to participate without overexposing your account.

As the trade develops, your confidence grows. This is where you add more size—at the technical levels that have a higher probability of holding, such as pivot lines or strong support/resistance zones.

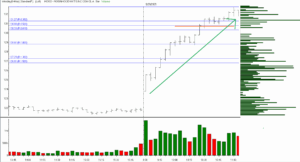

Today’s Example: NVIDIA (NVDA)

This morning’s setup in NVIDIA was a perfect case study in scaling into trades:

-

First entry: a small position at $186.38, where probabilities were moderate.

-

Second entry: a larger position at $185.73, where the pivot line gave us stronger conviction.

By weighting the second entry more heavily, the average price dropped closer to $185.73, making the trade much more favorable.

Stop Placement and Targets

A common mistake is placing stops too close to the first entry. Instead, manage risk with a tight stop below the pivot. This way, you’re not stopped out prematurely, only to chase the trade again. Even modest moves—just 20–30 cents—can deliver consistent profits when you’re positioned properly.

Why It Works

The beauty of scaling into trades is that it creates balance:

-

Smaller risk on uncertain entries.

-

Larger size where probabilities are stronger.

-

Consistent profit-taking instead of swinging for home runs.

Even if each trade nets only $200–$300, repeating that process throughout the day produces meaningful results.

Takeaway

If you’re serious about improving your trading consistency, start focusing on scaling into trades with purpose. It’s not about making the biggest score—it’s about stacking steady, repeatable profits by letting probabilities guide your lot sizing.

👉 Want to see how this played out live? Watch the full video here: Click Here

Trading Psychology and Premature Entries

The Psychology of Jumping the Gun in Trading

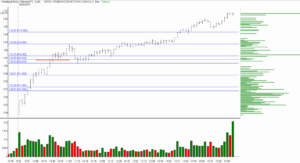

A friend and fellow trader called me on Monday and asked me to look at the chart of Robin Hood (HOOD) and “explain why the short was losing money.” I responded as I have many times in the past: if it were me, I would be waiting for a pullback to support and resistance at the Fibonacci confluence. Then, I’d take a long position in the direction of the trend.

He didn’t wait for the pullback. Instead, he entered long at the swing high and stopped out on the way down to the exact confluence of indicators that would have triggered a long entry by my rules. To make matters worse, he convinced himself that the drop proved he was “right all along” about the short—just before the stock reversed, ripped higher, and hit the logical profit objective.

Waiting for price to “come in” and reach the opportunity of confluence increases the odds of success dramatically.

Sound familiar? If so, you’re not alone. I’ve made the same mistake myself. Sometimes the urge to outsmart the market during an extreme move is irresistible. Unfortunately, markets can remain overbought or oversold far longer than we expect. Tops and bottoms often call to traders like sirens from the cliffs, and no number of wrecked accounts seems to silence the song. This is where trading psychology and premature entries collide.

Why We Do It

At the root of this behavior is a cocktail of fear of missing out (FOMO) and the illusion of control. When price makes a sharp move, our brains start running “what if” scenarios at lightning speed:

-

“If I don’t get in now, I’ll miss it.”

-

“It’s moved too far, so it must turn around.”

-

“I see something others don’t.”

Each of these thoughts feels logical in the moment but is fueled by emotion, not analysis. Worse, when we’re occasionally correct—catching the top or bottom once in a while—it reinforces the behavior. The brain remembers the win more vividly than the string of losses that came before and after. That’s why trading psychology and premature entries often go hand in hand.

The Hidden Risk of Being Right Sometimes

The most dangerous outcome isn’t losing a trade. It’s winning the wrong way. Being “right” on a reckless entry wires the brain to crave that high again, pushing traders to repeat the mistake with bigger size or less discipline. Over time, this creates a destructive cycle: chasing the rush instead of following the plan. Understanding trading psychology and premature entries is the first step toward breaking this cycle.

Breaking the Cycle

So how do you stop yourself from getting lured into the rocks?

✅ Anchor to process, not price.

Your edge lives in repeating setups with statistical validity. Write down your entry criteria and do not deviate.

✅ Use waiting as a tactic.

Tell yourself: “If it’s a true opportunity, it will come back to my level.” Patience is an action.

✅ Practice mental rehearsal.

Visualize watching a move run without you and feeling calm. Rehearsal reduces FOMO in live fire.

✅ Track your “impatience trades.”

Journal every time you enter too soon. The pattern—often embarrassing—creates the pressure you need to change.

Disciplined routines directly counteract the pull of trading psychology and premature entries that lead so many traders astray.

Final Thoughts

The HOOD chart was a perfect example: the market offered a clear, logical profit objective, but only to those who had the discipline to wait. Trading is rarely about outsmarting others. More often, it’s about outsmarting yourself. The sirens will always sing, but with the right preparation and mindset, you can steer safely past them—while others shipwreck on the rocks. The choice is yours: fall prey to trading psychology and premature entries, or master the discipline that keeps you in control.

US Pharma Tariff Cap

US Pharma Tariff Cap: Relief for Drugmakers Amid Trump’s Trade Moves

The Trump administration will honour a US pharma tariff cap of 15% on imports from the EU and Japan — far below the 100% levy initially threatened.

For drugmakers such as AstraZeneca, Eli Lilly, Novo Nordisk, and Merck, this means less disruption and more breathing room for ongoing U.S. investments.

What’s changing?

On Thursday night, President Trump announced 100% tariffs on imports of patented or branded drugs, effective October 1.

However, by Friday, clarification arrived: the cap will remain at 15% for EU and Japanese pharmaceutical companies, in line with existing trade agreements.

Generic drugs — the bulk of US imports — are exempt.

The administration also hinted at exemptions for companies “building” or “under construction” on US manufacturing facilities.

With multiple firms already racing to break ground, the sector is positioned to weather the tariff storm.

Industry response

- AstraZeneca, GSK, Novartis, and Roche have all announced new US manufacturing projects in recent months.

- Eli Lilly, Novo Nordisk: Already expanding domestic production of blockbuster weight-loss drugs.

- Merck: Shares moved in line with the market Friday, reflecting muted impact from the tariff clarification.

Morningstar analysts note that the tariff cap should have “minimal impact” on Big Pharma revenue and profits.

Instead, the sector’s bigger overhang remains pricing policy.

Market implications

Relief over the US pharma tariff cap removes a significant uncertainty that could have further pressured valuations.

Pharma stocks already trade at a steep discount to the S&P 500, around 13–14× forward earnings vs. 23× for the market.

The cap also rewards firms that expand US operations, reinforcing domestic manufacturing as a hedge against trade risk.

Day trading & swing ideas

- Gap setups: Watch AZN, LLY, and NVO for continuation moves if positive tariff headlines drive sector sympathy.

- Intraday volatility: Expect headline-driven spikes around Sept. 29 (Trump’s price-cut deadline).

Tight ranges could break on tariff + pricing news crossing wires. - Swing bias: With tariffs capped, pharma may attract bargain hunters.

Look for swing entries on pullbacks in AZN ($68–70 zone) and LLY ($565–570 support). - Relative strength play: Novo Nordisk (NVO) has outperformed peers; continuation toward $145–150 possible if tariff relief sticks.

Stocks to watch

| Ticker |

|---|

| AZN |

| LLY |

| NVO |

Watch for breakouts above resistance with volume for long swings.

Failed moves back under support can trigger short setups, especially if tariff exemptions remain unclear.

Bottom line

The US pharma tariff cap gives drugmakers near-term relief.

For day traders, it sets up headline volatility and sympathy plays.

For swing traders, it provides a backdrop for long setups in AZN, LLY, and NVO as the sector’s valuation gap could finally start to close.

Regret vs Disappointment: Trading Psychology Solutions

Every trader knows the sting of a trade gone wrong—but did you know that not all negative emotions are created equal? Performance psychology research highlights two powerful, yet distinct, responses to trading outcomes: regret vs disappointment. Understanding the difference between these emotional states—and learning how to manage them—can dramatically improve decision-making and consistency.

The Psychology of Regret vs Disappointment

Regret

Regret is tied to personal responsibility. It arises when a trader believes they made a poor decision that led to a bad outcome. For example:

-

“I should have stuck to my trading plan.”

-

“If only I had cut that loser earlier.”

Research shows that regret is a cognitively intense experience—it forces people to simulate alternatives (Zeelenberg et al., 1998) mentally. In trading, this means replaying the “what if” scenarios, which can spiral into self-criticism and hesitation. Accepting responsibility in making that decision, however, can also lead to creating better decision-making and practical solutions in the future.

Disappointment

Disappointment, by contrast, is triggered when outcomes don’t meet expectations but are perceived as outside one’s control. For instance:

-

“The Fed announcement blindsided the market.”

-

“I was in the right setup, but the stock got hit by unexpected news.”

Disappointment is less about self-blame and more about a mismatch between expectations and reality. Believing that events in trading are outside one’s control can undermine a trader’s confidence in their edge. This external locus of control does not lead to making different decisions or analyzing what could be done differently in the future.

Recognizing whether you’re dealing with regret vs disappointment helps determine the best recovery strategy.

Why the Distinction Matters for Traders

-

Regret can lead to overcorrection: traders avoid setups that match their plan because they fear making the same mistakes.

-

Disappointment can lead to discouragement, as traders doubt whether trading is “worth it” when outcomes feel uncontrollable.

Both states can erode discipline and consistency if left unmanaged. Performance psychology teaches us that recognizing which one we’re experiencing is the first step in choosing an effective coping strategy.

The ability to distinguish between regret and disappointment gives traders clarity, allowing them to respond with precision rather than emotion.

Performance Psychology Solutions

1. Cognitive Reframing for Regret

Instead of fixating on “should haves,” reframe regret into actionable learning:

-

Ask: “What rule or step did I skip?”

-

Act: Update your checklist or process to prevent it from happening again.

Evidence: Cognitive-behavioral approaches reduce regret intensity by focusing on controllable improvements (Roese et al., 2009).

2. Radical Acceptance for Disappointment

When an outcome was truly beyond your control, the best strategy is acceptance:

-

Say: “This was part of the game. I followed my edge, and that’s what matters.”

-

Practice: Brief mindfulness exercises help reinforce this acceptance.

Evidence: Acceptance-based interventions improve resilience in uncertain environments (Hayes et al., 2006).

3. Pre-Commitment to Reduce Both

Traders can pre-commit to rules that protect against both regret and disappointment:

-

Define maximum loss per trade.

-

Define the number of setups you’ll take per day.

-

Journal each decision to reinforce the process over the outcome.

Evidence: Implementation intentions (“If–Then” rules) reduce impulsivity and strengthen adherence to plans (Gollwitzer, 1999).

4. Emotional Labeling

Simply naming the emotion—“This is regret” or “This is disappointment”—creates distance between stimulus and response.

Evidence: Affect labeling reduces amygdala activation, allowing for better emotional regulation (Lieberman et al., 2007).

Applying the M.T.R.I.

The Manz Trader Readiness Inventory (M.T.R.I.) at TraderInsight.com provides a structured way to assess your vulnerability to regret versus disappointment. Traders with:

-

High Impulsivity → more prone to regret.

-

High Neuroticism → more prone to disappointment.

-

Strong Emotional Intelligence → better equipped to reframe and recover.

By understanding your profile, you can proactively target the psychological skills most relevant to you.

Conclusion

Both regret and disappointment are inevitable in trading—but they don’t have to derail you. With awareness, reframing, acceptance, and process-driven habits, traders can transform these emotions into fuel for growth.

👉 Take the M.T.R.I. at TraderInsight.com to measure your readiness, and start building the psychological edge you need to thrive.

Mastering regret vs disappointment is a cornerstone of developing resilience and consistency in trading.

The U.S. Soybean Trade Crisis

The U.S. soybean trade crisis: Market Shifts, Risks, and Opportunities

A Geopolitical Flashpoint

After years of tariff skirmishes and policy uncertainty, China has increased its reliance on South American supply, with Brazil shipping record volumes. Supply chains, once rerouted, seldom snap back quickly; that’s why analysts warn the shift may become structural rather than temporary. For farmers, the U.S. soybean trade crisis is both an economic and a political blow—affecting local lenders, rural employment, and community spending—while policymakers explore short-term relief and longer-term demand levers like higher biofuel blending.

Winners and Losers

- Winners: Brazilian growers, exporters, fertilizer and logistics firms capturing incremental share and pricing power with China.

- Losers: U.S. producers confronting softer basis, higher input costs, and storage constraints as bins fill into year-end.

Government aid can cushion the immediate hit, but checks don’t rebuild customers. The U.S. soybean trade crisis highlights a broader truth: agricultural cash flows depend as much on durable market access and infrastructure as on yields.

Trading & Investment Implications

- Soybean Futures (CME ZS): Expect harvest-season volatility. Watch weekly USDA export sales, Gulf/PNW basis, and key technical levels near prior harvest lows for tactical entries. Consider defined-risk options structures for headline risk.

- Crush Spreads (Meal vs. Oil): Track board crush (and implied processor margins). Policy moves that lift renewable diesel/SAF demand can buoy soybean oil, shifting the meal-oil dynamic.

- ETFs & Equities: Vehicles like SOYB provide directional exposure; Brazil-tilted agribusiness, fertilizer, and logistics names may benefit from flow persistence. Mind currency effects (USD/BRL) on returns.

- Credit & Regional Banks: Rising farm stress can filter into community banks heavy in ag lending—relevant for both equity and credit traders monitoring NPL trends.

- Calendar & Weather Risk: South American planting/harvest windows now carry outsized price impact; incorporate Brazil/Argentina weather into seasonal strategies.

Longer-Term Outlook

The U.S. soybean trade crisis is not only about near-term oversupply; it’s about potential permanent demand reallocation. If China’s sourcing pivot endures, U.S. acreage decisions could tilt toward other crops, altering North American rotations and global feed/oil balances. For market participants, that means expanding the dashboard: export inspections, South American yield monitors, freight spreads, policy headlines, and relative value across oilseeds (soy, rapeseed/canola, palm) all matter.

Playbook Checklist

- Define trigger levels for ZS and related option structures; pre-plan add/reduce rules.

- Track weekly export sales, inspections, and basis; align positions with verified flow.

- Monitor crush margins and renewable diesel policy; adjust oil/meal exposure accordingly.

- Diversify geographically via Brazil/Southern Cone proxies; manage FX overlay.

- Stress-test ag-exposed credit and regional banks for knock-on effects.

Conclusion

Trade policy has reshaped the soybean map, and agility will be rewarded. Align positions with the evolving balance of supply, demand, logistics, and policy—while respecting seasonal volatility and headline risk. Building a framework now positions traders to navigate the next leg of this multi-year shift.

Note: This article expands on themes widely reported in financial media and public data; it is for educational purposes and is not investment advice.

Conquering FOMO in Trading: A Performance Psychology Perspective

Conquering FOMO in Trading: A Performance Psychology Perspective

Conquering FOMO is one of the biggest challenges traders face on their path to consistent performance. Fear of Missing Out (FOMO) can appear as a simple emotional nudge, but research in performance psychology reveals that it undermines judgment, increases impulsivity, and compromises disciplined execution. To trade effectively, it’s essential to understand how FOMO works and develop strategies to keep it from taking control.

The Psychology of FOMO in Trading

In psychology, FOMO is linked to anticipatory anxiety—the fear that others are benefiting while you are left behind. Przybylski et al. (2013) define it as a “pervasive apprehension that others might be having rewarding experiences from which one is absent” (Computers in Human Behavior, 29, 1841–1848).

For traders, this appears as chasing a stock that’s already in motion. The thought “I’m losing money by not being in this trade” can trigger stress and rash action. Research further shows that high impulsivity and low emotional stability make it harder to resist these urges (Carleton et al., 2019; Journal of Anxiety Disorders, 61, 52–63).

Cognitive and Emotional Drivers

- Scarcity Bias – Opportunities appear more valuable because they feel fleeting.

- Social Comparison – Watching others succeed intensifies competitive pressure.

- Loss Aversion – Missing out feels like a financial loss, even when no trade occurred.

- Reward Pathways – Dopamine spikes reinforce risky, last-minute entries.

Understanding these forces is the first step in conquering FOMO and protecting your trading discipline.

In-the-Moment Exercises to Reduce FOMO Impulsivity

Performance psychology offers practical, evidence-based tools to help traders regain control the moment FOMO strikes:

- STOP Technique — Stop, Take a breath, Observe your thoughts, Proceed mindfully (Segal et al., 2013).

- Box Breathing — Inhale 4, hold 4, exhale 4, hold 4; repeat to calm stress and support impulse control (Jerath et al., 2015).

- Implementation Intentions — “If I feel the urge to chase, then I will pause for 60 seconds and review my plan” (Gollwitzer, 1999).

- Journaling Micro-Pause — Write one sentence: “What rule am I about to break, and what’s the cost?” (Pennebaker, 1997).

- Affect Labeling — Say “This is FOMO.” Naming emotions reduces reactivity (Lieberman et al., 2007).

Measuring Your Readiness: The M.T.R.I.

Another powerful step is to measure your psychological profile. The Manz Trader Readiness Inventory (M.T.R.I.), developed at TraderInsight.com, evaluates Emotional Intelligence, Cognitive Reflection, Risk Profile, Impulsivity, and Emotional Stability. By highlighting strengths and vulnerabilities, the M.T.R.I. helps traders design a personalized plan for conquering FOMO and trading with greater consistency.

Conclusion

FOMO is universal, but in trading, it can be especially destructive. Left unchecked, it drives impulsivity, overtrading, and loss of confidence. Evidence-based tools—STOP, box breathing, if–then planning, journaling, and emotion labeling—offer fast ways to interrupt the cycle. Pairing these with the M.T.R.I. creates a framework for growth and lasting success.

Start your journey toward conquering FOMO today by taking the M.T.R.I. at TraderInsight.com.

References

- Przybylski, A. K., Murayama, K., DeHaan, C. R., & Gladwell, V. (2013). Motivational, emotional, and behavioral correlates of fear of missing out. Computers in Human Behavior, 29(4), 1841–1848.

- Carleton, R. N., et al. (2019). Fear of the unknown: A mechanism underlying anxiety disorders? Journal of Anxiety Disorders, 61, 52–63.

- Segal, Z. V., Williams, J. M. G., & Teasdale, J. D. (2013). Mindfulness-Based Cognitive Therapy for Depression. Guilford Press.

- Jerath, R., Edry, J. W., Barnes, V. A., & Jerath, V. (2015). Physiology of long pranayamic breathing. Medical Hypotheses, 85(3), 486–496.

- Gollwitzer, P. M. (1999). Implementation intentions: Strong effects of simple plans. American Psychologist, 54(7), 493–503.

- Pennebaker, J. W. (1997). Writing about emotional experiences as a therapeutic process. Psychological Science, 8(3), 162–166.

- Lieberman, M. D., et al. (2007). Putting feelings into words: Affect labeling disrupts amygdala activity. Psychological Science, 18(5), 421–428.