Forgotten Profits Trade Setup Archive

Below you'll find Ian's setups stacked up and ordered chronologically. As this service once resided at another home, the alerts only go back to mid July. For a full track record, see the portfolio.Nvidia AI Backstop

Nvidia AI Backstop: How $100 Billion Fuels the Next Leg of the Boom

Nvidia has turned its free cash flow machine into a war chest for AI.

By acting as an Nvidia AI backstop, the company is funneling billions into CoreWeave, Nscale, and OpenAI.

The payoff? Locked-in demand for its GPUs — and a bigger moat around its dominance.

The cash problem — and solution

Nvidia has generated $112 billion in free cash flow in just six quarters. After $58 billion in buybacks and soaring R&D, the pile is still growing.

With M&A largely off the table in today’s regulatory climate, Jensen Huang has crafted a new playbook: create customers by financing them.

That’s how CoreWeave went from $16 million in revenue to an $80 billion valuation. That’s how Nscale in the U.K. just raised $1.1 billion.

And that’s how OpenAI secured up to $100 billion for 10 gigawatts of new data centers — with Nvidia ensuring those racks will be filled with its GPUs.

Circular financing explained

The structure is simple: Nvidia invests in AI companies, those companies use the funds to buy Nvidia chips, and Nvidia books the revenue.

Some analysts call it “circular,” but for Nvidia it ensures growth doesn’t stall.

The OpenAI deal alone added nearly $160 billion in NVDA market cap.

- CoreWeave: Early backstop, now $80B valuation, $6.3B capacity buyback deal with Nvidia.

- Nscale: U.K. CoreWeave clone, christened by Huang, fast-tracked with contracts from Microsoft and OpenAI.

- OpenAI: $100B Nvidia commitment locks in GPU demand for a decade-scale buildout.

Market implications

Nvidia isn’t just selling hardware — it’s underwriting the AI ecosystem.

That makes it the “investor of last resort” in AI, as one analyst put it.

While critics worry about concentration risk and circular financing, Wall Street so far sees a guarantee of sustained demand.

The bigger takeaway: Nvidia is using its balance sheet like a weapon, ensuring competitors can’t match its scale of customer creation.

Day trading ideas

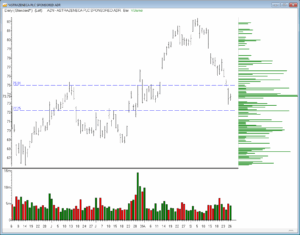

- NVDA intraday levels: Support sits near $175 (psychological round number), resistance at $183. ATR(14) is $5.30 — expect 1–1.5× ATR swings on news flow.

- Sympathy trades: Watch Oracle (ORCL) and Microsoft (MSFT), both tied to AI data centers. Positive NVDA headlines often spill over.

- High-beta plays: CoreWeave (CRWV) and other AI-exposed small caps move sharper than NVDA — gap-and-go setups likely on financing news.

- Pairs trade: Long NVDA vs. short AMD if Nvidia headlines dominate. The spread often widens intraday when NVDA rallies on AI deals.

Technical levels to watch

| Ticker | Support | Resistance | ATR (14d) |

|---|---|---|---|

| NVDA | $175.00 | $183.00 | $5.30 |

| ORCL | $258.71 | $312.75 | $7.10 |

| MSFT | $497.18 | $519.10 | $7.60 |

Breakouts above resistance with volume can target 1–2× ATR extensions. Failed breakouts that slip back under support set up short opportunities with defined risk.

Implications for NVDA intraday & swing trading

- Intraday setups: News of new Nvidia financing deals tends to spark opening gaps. Traders can look for opening-range breakouts or fade setups, depending on whether volume confirms follow-through.

- Volatility spikes: Expect outsized intraday moves around announcements tied to OpenAI, xAI, or Nscale. NVDA often runs 1.5× ATR on those days.

- Swing bias: As long as NVDA holds above $175 support on daily closes, swing traders can stay biased long, targeting $180–183 over the next 2–3 weeks.

- Event risk: A break below $171 with volume would shift swing setups short, with $167 – $171 as the downside target.

- Sector confirmation: Pair swing longs in NVDA with tech ETF exposure (XLK, QQQ) when the Nasdaq is trending higher — this amplifies directional conviction.

Bottom line

The Nvidia AI backstop strategy is unprecedented: one company underwriting the entire AI buildout.

For long-term investors, it ensures Nvidia stays at the center of the boom.

For day traders, it creates frequent intraday catalysts and sympathy plays.

For swing traders, the roadmap is narrow — above $175, target $183; below $175, target $171.

Either way, Nvidia remains the most tradable stock in the AI universe.

Article Archives – TraderInsight – see more recent commentary and trading ideas, including pharmaceutical sector projections in light of recent Trump administration policy indications.

AstraZeneca Drug Discounts

AstraZeneca Drug Discounts Show Pharma’s Response to Trump’s Pressure

With a Trump administration deadline looming, AstraZeneca announced it will cut prices on key asthma and diabetes drugs by as much as 70%.

The move is part of a broader trend: drugmakers racing to roll out direct-to-consumer platforms to meet demands for lower U.S. drug prices.

The announcement

Starting October 1, AstraZeneca will allow eligible patients to buy Airsupra and Farxiga directly for cash at steep discounts.

The company joins Bristol Myers Squibb, which earlier this week expanded its own program with up to 80% discounts on select medicines.

Both announcements follow Trump’s July warning: companies had until September 29 to propose meaningful price cuts or face government action.

Why it matters

- Direct-to-consumer shift: Pharma is bypassing pharmacy benefit managers and insurers to show immediate price relief.

- Preemptive strategy: Discounts may blunt harsher policy moves, including Medicare price negotiations and international benchmarking.

- Sector signal: Multiple drugmakers moving at once suggests industry consensus: Trump’s deadline has real teeth.

Market implications

Investors are weighing the trade-off: near-term revenue compression versus long-term regulatory certainty.

AstraZeneca stock edged higher after the news, suggesting Wall Street prefers voluntary, controlled discounting over forced, unpredictable cuts.

Still, analysts warn margins will tighten, especially if discounts extend to blockbusters across diabetes, oncology, and autoimmune franchises.

Trading takeaways

For traders, the theme is clear: pharma stocks are cheap relative to the market, but policy headlines will drive volatility.

Relief rallies are possible if companies get credit for meeting Trump’s demands without deeper government intervention.

But risk remains if regulators decide voluntary cuts don’t go far enough.

Day trading ideas

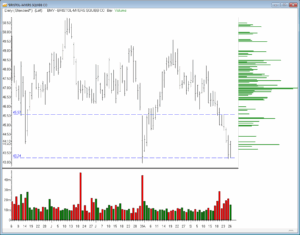

- AZN intraday momentum: Watch AstraZeneca (AZN) around the $70–72 range. Breakouts above resistance could trigger fast momentum trades on positive news flow.

- Sector sympathy plays: Bristol Myers (BMY) and Novo Nordisk (NVO) may move in sympathy as traders anticipate further discount announcements. Look for gap setups at the open.

- Headline scalps: Expect volatility spikes around Sept. 29 — the Trump deadline. Quick reaction trades on breaking headlines could offer scalping opportunities.

- Pairs trade: Long AZN vs. short SPDR S&P Biotech ETF (XBI) if AstraZeneca’s voluntary cuts appear better received than peers forced into deeper concessions.

Technical levels to watch

| Ticker | Support | Resistance | ATR (14d) |

|---|---|---|---|

| AZN | $72.25 | $75.01 | $1.31 |

| BMY | $43.25 | $45.57 | $0.90 |

Use the ATR (Average True Range) as a volatility gauge. A breakout above resistance with volume could target 1–1.5 times the ATR extension intraday.

Conversely, failed breakouts back through support may set up short entries with tight stops.

Bottom line

AstraZeneca drug discounts highlight the new playbook: go direct, slash prices, and try to stay ahead of Washington.

For investors, that means compressed margins. For day traders, it means headline-driven setups, sympathy plays, and now clear technical levels for intraday execution.

Volatility is opportunity — but only if risk is managed tightly.

Drug Pricing Uncertainty

Drug Pricing Uncertainty Keeps a Lid on Pharma Stocks

The Trump administration’s 100% tariffs on foreign-made drugs sounded harsh. In reality, Big Pharma can live with them.

What the sector can’t shake is drug pricing uncertainty — and until investors get clarity, valuations will remain under pressure.

Tariffs are survivable

Trump’s announcement of a 100% levy on imported drugs that aren’t tied to U.S. plants was nearly a best-case outcome.

Most large-cap drugmakers — from Pfizer to Merck — already have billions earmarked for U.S. facilities.

More than $350 billion in domestic pharma investments are pledged through the decade, shielding them from the tariff hit.

That explains why the NYSE Arca Pharmaceutical Index rose just 1% after the news. Investors aren’t worried about tariffs. They’re worried about pricing.

The real risk: drug pricing uncertainty

The administration has set a September 29 deadline for companies to align U.S. drug prices with the lowest charged in developed markets.

Reports suggest that Medicare and Medicaid could begin pilot programs benchmarking U.S. prices against international standards — an echo of Trump’s first-term ideas that sparked lawsuits.

Add in the Inflation Reduction Act, which allows Medicare to negotiate prices on top-selling drugs, and you have a recipe for unpredictable cuts.

Analysts warn Trump may use that framework aggressively, forcing 30%–50% discounts on blockbusters like Novo Nordisk’s Ozempic or Teva’s Austedo.

Investor implications

- Valuation gap: The pharma index trades at just 13.6× forward earnings vs. 23× for the S&P 500 — a 40% discount.

- Margin pressure: Mid-teen net profit margins are sustainable, but deeper U.S. cuts could erode the buffer.

- Event risk: With drug lists due in November, volatility is likely around announcements and litigation headlines.

In short, targeted margin hits are manageable, but the lack of clarity around which drugs, how much, and when they will occur is what weighs on valuations.

Trading takeaways

For traders, the setup is straightforward: pharma stocks are cheap, but catalysts are binary. Relief rallies are possible once pricing clarity emerges, even if cuts sting.

Until then, expect range-bound trade with spikes around tariff, Medicare, or White House headlines.

Bottom line

Big Pharma can manage Trump’s tariffs. What they can’t manage is not knowing the size and scope of drug price cuts.

As long as drug pricing uncertainty dominates, Wall Street will stay cautious.

The good news? Much of the risk appears to be priced in. A sector rally could follow once the pain has a number attached to it.

Perpetual Futures Trading

Perpetual Futures Trading: Why ‘Perps’ Are Driving a New Speculation Boom

Crypto traders are rushing into perpetual futures trading, contracts known as “perps” that allow investors to apply leverage of 10, 20, or even 100 times on bitcoin.

Once largely offshore, perps are now entering regulated U.S. markets — and the risks and rewards are both exploding.

What are perps?

Perpetual futures are derivatives that mimic traditional futures but never expire. They track the spot price of bitcoin, with gains or losses realized continuously.

A funding rate mechanism keeps perp prices tethered to spot — longs pay shorts when demand overheats, and vice versa.

Example: With $500 at 10× leverage, a trader controls $5,000 worth of bitcoin. A 10% move in price doubles the stake; a 10% drop wipes it out.

Why they are exploding now

- Volume surge: Perps now account for 68% of Bitcoin trading volume, according to Kaiko.

- Retail access: Coinbase, Robinhood (Europe), and Gemini (globally) offer perps with leverage ranging from 10× to 100×.

- Institutional adoption: Cboe plans to launch perpetual contracts (perps) this November, signaling mainstream recognition.

With Bitcoin up more than 70% this year, speculative appetite has surged across both crypto and equities.

From meme stocks to one-day options, perps fit neatly into a market craving leverage and speed.

What it means for traders

- Upside potential: Fast gains possible with small capital outlay.

- Hidden costs: Funding rates can erode returns, especially in crowded long trades.

- Broker benefit: Firms earn higher revenues from derivatives than stock trades — expect platforms to push perps aggressively.

- Volatility risk: Extreme leverage amplifies losses; a single wrong move can wipe accounts instantly.

Who really wins?

History suggests the house often comes out ahead. For Robinhood, Coinbase, and other platforms, perps represent lucrative new revenue streams.

For traders, they represent opportunity — but also a dangerous arena where discipline, risk sizing, and stop-losses are non-negotiable.

Bottom line

The rise of perpetual futures trading signals another speculative chapter for financial markets.

As perps spread from offshore exchanges to mainstream brokers, traders will have easier access to massive leverage.

That access cuts both ways: fortunes can be made in hours, or lost just as fast. For most, the winner may not be the trader at all — but the broker taking the other side.

Day Trading Margin Rule Change

Day Trading Margin Rule Change: What It Means for Retail Traders

For over two decades, retail traders have been operating under the shadow of the Pattern Day Trader rule.

If your account dropped below $25,000, you were locked out after four day trades in five days.

Now, regulators are preparing the most significant day trading margin rule change since 2001. The minimum equity threshold is set to fall to just $2,000.

From $25K to $2K

FINRA has approved amendments to replace the blanket $25,000 rule. The proposal now heads to the SEC for review.

If enacted, a trader with just $2,000 in equity would have unrestricted access to day trading.

Instead of a hard lockout, intraday buying power will be tied directly to existing margin requirements and broker-level risk controls.

Why the change now?

The PDT rule was created in 2001 after the dot-com crash. Regulators feared small accounts were taking reckless bets on volatile internet stocks.

Back then, commissions were high and risk systems were primitive.

Fast forward to today: zero-commission trading is the norm, brokers monitor risk in real-time, and access to markets has expanded significantly.

Supporters argue that the $ 25,000 barrier is outdated and unfairly favors wealthier investors.

What it means for retail traders

- Lower entry point: Qualifying with just $2,000 means smaller accounts can participate fully.

- Access to leverage: Accounts that meet the new minimum could see up to 4:1 intraday margin — the same buying power larger accounts enjoy today.

- Brokers in control: Firms will set risk limits in real time. Expect tiered margin access and tighter controls on volatile names.

Critics see risk

Not everyone is cheering. Skeptics warn that lowering the bar could lead to undisciplined trading and spark increased volatility.

Small accounts with 4× leverage are one bad trade away from margin calls.

Regulators are betting that modern risk systems — and broker oversight — can keep excesses in check.

Bottom line

The day trading margin rule change could reshape retail trading for the first time in a generation.

For small investors, it means fewer roadblocks, more flexibility, and access to professional-level buying power.

But with opportunity comes risk. A $2,000 account levered 4:1 controls $8,000 worth of stock — a 5% swing in the market means a 20% swing in equity.

As the SEC reviews the proposal, one thing is clear: access is expanding, but discipline will matter more than ever.

Alibaba AI Spending Rally

Alibaba AI Spending Rally: Why the Stock Could Climb Even Higher

Alibaba (BABA) shares jumped 10% after the company announced new AI spending, overseas data centers, and the unveiling of Qwen3-Max, its trillion-parameter AI language model.

The Alibaba AI spending rally is boosting investor sentiment — and the stock could still have room to run.

Why the stock is soaring

- AI catalyst: Launch of Qwen3-Max, Alibaba’s largest model to date, positions the company to compete globally in generative AI.

- Global expansion: New data centers abroad increase scale and cloud competitiveness.

- Nvidia partnership: Integration of Nvidia tools into robotics and self-driving AI further validates its growth path.

Shares have nearly doubled in 2025, climbing over 35% in just the last month and reaching levels not seen since 2021.

Wall Street’s stance

Analysts remain generally positive, with Alibaba carrying a consensus “Buy” rating from over 50 analysts and no “Sell” calls.

Current targets cluster around $167–$179, but upside revisions could follow given the latest momentum in AI.

- Nomura: Buy, $170 target, citing improving retail unit efficiency and narrowing per-order losses.

- Morningstar: Hold, $179 target, citing undervalued AI cloud potential and management execution.

- U.S. Tiger Securities: Buy, $145 target, emphasizing Jack Ma’s return as a sentiment driver.

Key drivers of the Alibaba AI spending rally

- Retail recovery: Quick-commerce brand investments set to halve per-order losses by October.

- AI demand: New opportunities emerging from education, healthcare, and enterprise AI training.

- Leadership factor: Jack Ma’s informal return boosts confidence with employees, investors, and potentially Beijing regulators.

Risks to watch

- Regulation: Beijing’s antitrust crackdowns could return, impacting revenue and margins.

- U.S. Compliance: ADR Disclosure Rules Add Uncertainty for Overseas Investors.

- Valuation risk: At ~18x forward earnings, Alibaba trades below S&P tech peers, but sentiment could shift quickly.

Bottom line

The Alibaba AI spending rally reflects both a turnaround in fundamentals and improving sentiment around Chinese tech.

With AI expansion, Nvidia partnerships, and Jack Ma’s renewed influence, Alibaba could continue climbing — though regulatory and geopolitical risks remain wildcards.