The Small Cap Swing Trader Alert Archive

Below you'll find The Small Cap Swing Trader setups stacked up and ordered chronologically.March 13, 2025

📌 Recent Market Drop Is Rare – What Happens Next?

The Speed and Magnitude of the Recent Market Drop Is Rare—Here’s What Typically Happens Next

Introduction

The recent market selloff has been one of the fastest and most dramatic declines. With high volatility and rapid price swings, traders wonder what happens next.

While no two downturns are identical, historical patterns can provide valuable insights into the phases that typically follow such steep declines. If you’re looking for trading strategies that work in volatile markets, this guide will help you prepare for the next move.

How This Market Drop Compares to Historical Selloffs

Market crashes of this magnitude are rare, but they follow predictable cycles. Here’s what typically happens next:

1. Expect a Sharp Reflex Rally (Bear Market Bounce)

After a steep decline, markets often experience a short-term bounce driven by bargain hunting, short-covering, and institutional buying.

📈 Example: The 2020 COVID crash sharply declined in March, followed by a quick rally before another pullback.

✅ Trading Strategy: Don’t blindly chase rebounds—wait for confirmation through technical indicators like support levels, moving averages, and volume analysis.

2. Increased Volatility and Retesting of Lows

Markets don’t recover in a straight line. Instead, we often see a retest of previous lows before a true uptrend begins.

📉 Example: The 2008 Financial Crisis had multiple failed rallies before the actual bottom in March 2009.

🔍 What to Watch For:

- VIX (Volatility Index) spikes indicate uncertainty

- Institutional accumulation signals a potential reversal

- Bear market traps (where false breakouts lure traders in before reversing lower)

3. Sector Rotation and Market Leadership Changes

New leaders emerge after major downturns, and traders who recognize these shifts early have the best opportunities for big gains.

📊 Example:

- Tech stocks struggled after the 2000 dot-com crash while energy and commodities soared.

- Financial stocks took years to recover after the 2008 crisis, but tech and consumer discretionary led the next bull market.

🛠️ Trading Strategy: Use relative strength analysis to identify emerging sector leadership.

4. Fed and Government Policy Responses Can Shape Recovery

Sharp declines often lead to monetary policy adjustments, such as:

- Interest rate cuts

- Liquidity injections

- Stimulus packages

🏦 Example: In March 2020, the Federal Reserve stepped in aggressively, leading to one of the fastest recoveries in history.

📌 What This Means for Traders: Watch for policy changes—they often trigger market pivots and opportunities.

5. The Best Trading Opportunities Emerge After Panic Selling

While market crashes cause fear, they also create some of the best buying opportunities for traders who follow a structured strategy.

🔥 Proven Strategies for Market Downturns:

✅ Volatility Band Trading – Capturing high-probability reversals in extreme market conditions

✅ Momentum-Based Scalping – Finding short-term trade opportunities

✅ Institutional Order Flow Analysis – Following smart money movements

🛠️ Actionable Tip: Wait for trend confirmation signals before entering long trades.

What’s Next for Traders? Learn to Navigate Market Uncertainty Like a Pro

This market drop is rare in both speed and magnitude, but history shows that opportunities follow volatility. The key is to have a structured approach, use proven strategies, and avoid emotional trading.

If you want to master battle-tested trading strategies that thrive in volatile markets, join us at the Income Trading Boot Camp, June 8-11, 2025, in Miami Beach.

👉 Click here to learn more and apply now

By attending, you’ll learn:

✔️ How to identify high-probability trades in volatile markets

✔️ Institutional trading techniques for better execution

✔️ Real-time market analysis and strategy implementation

📍 Location: Cadillac Hotel and Beach Club, Miami Beach

📅 Dates: June 8-11, 2025

🎟️ Limited Spots: Only 3 seats left for new attendees!

Take control of your trading future—secure your spot today!

Intel’s Foundry Shake-Up: TSMC Pitches Joint Venture to Nvidia, AMD, and Broadcom

Intel’s Foundry Shake-Up: TSMC Pitches Joint Venture to Nvidia, AMD, and Broadcom

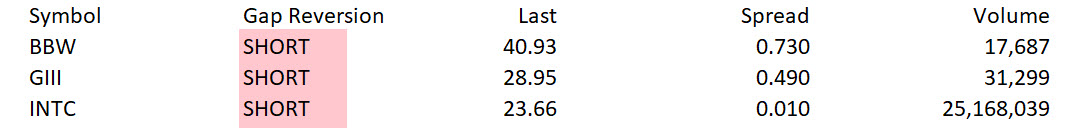

Intel Corporation (NASDAQ: INTC) has been struggling to regain its competitive edge in the semiconductor industry, and a new development could mark a turning point. Reports indicate that Taiwan Semiconductor Manufacturing Company (TSMC) has pitched a joint venture proposal to Nvidia (NASDAQ: NVDA), Advanced Micro Devices (NASDAQ: AMD), and Broadcom (NASDAQ: AVGO) to help manage Intel’s foundry operations. This potential restructuring has already caused ripples in the market, with Intel’s stock surging over 5% on the news.

The Proposed Joint Venture: What We Know

According to Reuters, TSMC has approached prominent U.S. chip designers about forming a joint venture to take over Intel’s struggling foundry division. Under the proposed agreement, TSMC would handle operations but not hold over 50% ownership stake, ensuring that the foundry remains under U.S. control. The initiative has reportedly garnered interest from Qualcomm (NASDAQ: QCOM).

Why This Matters for Traders

Intel’s foundry business has faced challenges, including an $18.8 billion net loss in 2024. The company’s inability to compete effectively with TSMC and Samsung in advanced chip manufacturing has placed pressure on its bottom line. A strategic partnership with TSMC and leading AI chip designers could revitalize the business, making Intel a stronger competitor.

For investors, the potential deal presents both opportunities and risks:

- Positive Catalyst: If successful, the joint venture could increase efficiency, improved manufacturing capabilities, and a stronger market position for Intel.

- Regulatory Uncertainty: Any agreement will require U.S. government approval, given concerns over maintaining domestic control over semiconductor manufacturing.

- Stock Movement: Intel shares saw a 5.5% spike following the news (Business Insider), signaling renewed investor optimism.

How Traders Can Capitalize on This News

- Watch for Regulatory Developments – The U.S. government’s stance on this partnership will be crucial to its success. Any roadblocks could lead to volatility in Intel’s stock.

- Monitor Competitor Reactions – How will other foundry competitors like Samsung respond? Market positioning among semiconductor giants could shift rapidly.

- Analyze Price Action and Technicals – Given the recent rally in INTC stock, traders should look for confirmation signals before entering positions.

Final Thoughts

Intel’s potential partnership with TSMC, Nvidia, AMD, and Broadcom is a significant development that could reshape the semiconductor landscape. With AI and high-performance computing driving demand for advanced chips, this joint venture could boost Intel. However, traders should stay informed about regulatory proceedings and market reactions before making investment decisions.

For ongoing updates on trading opportunities in the semiconductor space, check back at TraderInsight.com.

March 12, 2025