The Small Cap Swing Trader Alert Archive

Below you'll find The Small Cap Swing Trader setups stacked up and ordered chronologically.Soft Inflation Print Spurs Rally – Afternoon Strategy Breakdown

March 11, 2025

Market Volatility Benefits Day Traders

Market Volatility Benefits Day Traders While Investors Struggle

Market turbulence often sends long-term investors into panic mode, but for active traders, volatility is a goldmine of opportunity. While traditional investors watch their portfolios shrink due to sharp market swings, day traders thrive on these fluctuations, leveraging intraday price movements for profit. In today’s fast-moving environment, market volatility benefits day traders by offering more setups, bigger price swings, and increased liquidity—all essential ingredients for successful short-term trading.

Why Market Volatility Hurts Investors But Helps Day Traders

Market volatility can devastate long-term investors because it leads to unpredictable price swings, often driven by macroeconomic concerns, earnings surprises, or geopolitical events. Those relying on buy-and-hold strategies experience sudden losses with little control over market direction.

However, day traders capitalize on these fluctuations. Increased price action means more opportunities to enter and exit trades quickly, reducing exposure to long-term market uncertainty. When major indexes experience large swings, traders using momentum-based strategies—like those covered in The Precision Trading Webinar Replay—can profit from rapid moves in both directions.

To better understand how volatility impacts markets, see our analysis on VIX Levels and Market Impact, which explains how traders can use the VIX (Volatility Index) to gauge market conditions.

Increased Liquidity and Faster Price Action

One key reason market volatility benefits day traders is the spike in liquidity. Higher trading volume means tighter bid-ask spreads, allowing for more precise entries and exits. This is crucial when executing short-term strategies such as:

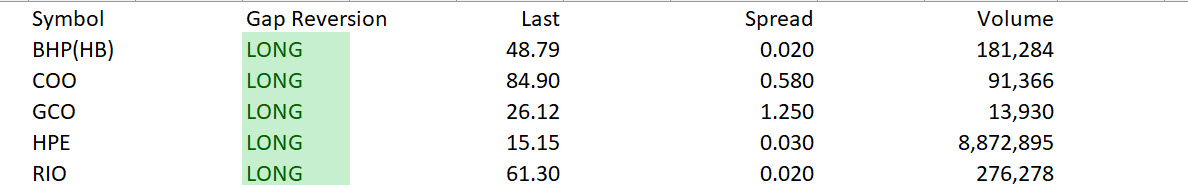

- Gap trading – Using pre-market price movements to predict opening gaps and reversals.

- Momentum trading – Taking advantage of stocks making explosive moves due to news catalysts.

- Mean reversion – Identifying extreme price movements and trading against the trend.

For an external perspective on market liquidity and volatility, check out Investopedia on Market Liquidity, which explains why liquidity matters for active traders.

How Economic Reports and Earnings Season Boost Volatility

Day traders should always track economic reports and earnings announcements, as these events significantly increase market movement. For instance, when the Federal Reserve releases interest rate decisions or employment data, indices like the S&P 500 can experience rapid swings.

Earnings season is another gold mine for short-term traders. Stocks often react unpredictably to earnings reports, even if results meet expectations. Market volatility benefits day traders by providing multiple setups, whether through pre-market breakouts, after-hours reversals, or intraday trends.

External reference: The CME Group’s Economic Calendar provides a real-time schedule of major economic releases that can impact market volatility.

Geopolitical Events and Market Fluctuations

Geopolitical tensions, such as trade disputes or unexpected policy changes, often drive volatility spikes. One example is how tariffs on imported goods have disrupted global markets. TraderInsight’s analysis of tariffs’ impact on the auto supply chain explores how these macroeconomic factors create short-term trading opportunities.

For an external deep dive, Reuters covers geopolitical market risks with real-time updates on global financial trends.

Using Volatility to Maximize Gains and Minimize Risk

To successfully trade in volatile markets, a disciplined approach is crucial. Here are some key strategies:

1. Tight Risk Management

- Use stop-loss orders to protect against extreme moves.

- Adjust position sizes to avoid overexposure.

- Stick to high-probability setups with a clear risk-reward ratio.

2. Trading Only the Best Setups

Not every market move is an opportunity. Focus on trades with strong technical confirmation and avoid overtrading. Market volatility benefits day traders who remain selective and disciplined.

3. Adapting to Changing Market Conditions

Different volatility environments require different approaches. For example, a low-volatility market may favor breakout strategies, while a high-volatility market rewards mean reversion trades.

The SEC’s guide on managing investment risk is a valuable external reference on risk management.

Conclusion: The Best Time for Day Traders to Profit

While traditional investors endure market uncertainty, active traders benefit from chaos that punishes long-term portfolios. By understanding how market volatility benefits day traders, you can position yourself to take advantage of short-term price swings, increased liquidity, and rapid market movement.

Want to refine your trading skills and master volatile market conditions? Join us for the replay of my Precision Trading webinar and learn how to turn volatility into profit.

Good Trading,

Adrian Manz

March 7, 2025

VIX levels and market impact

The Impact of Elevated VIX Levels on Market Internals

Understanding the VIX and Current Market Conditions

As of March 6, 2025, the Cboe Volatility Index (VIX), commonly called the “fear gauge,” closed at 25.49, reflecting a significant increase from its previous close of 21.93 on March 5, 2025. This marks the highest closing level since December 18, 2024. This surge in VIX levels and market impact has sparked concerns among investors regarding broader market stability.

The VIX measures the market’s expectations of volatility over the next 30 days, derived from S&P 500 index options. A higher VIX value indicates increased investor anxiety and anticipated market fluctuations. Typically, VIX levels below 15 suggest optimism and stable markets, between 15 and 25 indicate moderate volatility, and above 25 reflect significant market turbulence and heightened investor fear.

How Elevated VIX Levels Impact Market Internals

The recent surge in the VIX suggests that investors are increasingly concerned about potential market downturns. This heightened volatility often leads to increased demand for protective options strategies, such as purchasing put options, which can increase option premiums. Consequently, this behavior can result in wider bid-ask spreads and reduced liquidity, affecting overall market efficiency.

Elevated VIX levels also correlate with shifts in market internals, including market breadth and momentum. Periods of high volatility often see a decline in the number of advancing stocks relative to declining ones, indicating weakening market breadth. Additionally, momentum indicators may turn negative as increased uncertainty prompts investors to reduce exposure to riskier assets.

Duration of Elevated VIX and Market Impact

Historically, a persistently high VIX can keep markets under pressure for weeks or months, depending on the underlying cause of the volatility spike. If the increase is event-driven—such as geopolitical tensions, central bank policy changes, or significant earnings misses—markets may stabilize once the uncertainty is resolved. However, in cases where economic fundamentals are deteriorating, an elevated VIX can sustain bearish sentiment for an extended period.

Typically, market sell-offs tend to accelerate when the VIX rises above 30 as panic sets in. However, when the VIX declines from peak levels and moves back toward 20, it often signals that fear is subsiding, and a potential reversal rally could be imminent. A VIX dropping below 20 generally suggests a return to normalcy and investor confidence, often corresponding with a rebound in stock prices.

Impact on the Magnificent 7 and High-Quality Stocks

One of the most unexpected developments in the current market environment is the impact on the so-called Magnificent 7 and high-quality stocks, including Apple, Microsoft, Amazon, Google (Alphabet), Nvidia, Meta, and Tesla—along with other high-quality stocks that previously appeared bulletproof. Traditionally, these companies have been seen as resilient, even during economic slowdowns, due to their strong balance sheets, dominant market positions, and continued growth prospects.

However, the elevated VIX and increased market uncertainty have led to an outsized impact on these stocks. Many investors had anticipated that these names would serve as safe havens, yet they are now experiencing sharper declines than expected. Factors contributing to this include profit-taking after strong rallies, concerns over slowing earnings growth, and shifting investor sentiment away from high-valuation technology stocks toward defensive sectors.

The underperformance of these previously resilient stocks signals a broader risk-off sentiment in the market. If these stocks continue to struggle, it could exacerbate overall market declines, given their significant weighting in major indices like the S&P 500 and Nasdaq. Investors should keep a close watch on whether these companies regain footing or if further downside pressure persists, which could influence broader market stability.

Conclusion

The elevated VIX level reflects growing investor unease and suggests potential short-term challenges for the broader market’s internal dynamics. Market participants should monitor these developments closely and consider appropriate risk management strategies to navigate the heightened volatility.